Introduction

The Boeing Company is one of the world’s largest aerospace and defense corporations, renowned for its cutting-edge innovations in commercial aviation, space exploration, and military systems. Headquartered in Arlington, Virginia, Boeing plays a pivotal role in global mobility and national defense, supplying aircraft, satellites, and defense systems to customers across more than 150 countries.

Illustration1 : The Boeing logo, a global symbol of aviation excellence and aerospace innovation.

Boeing operates across several major sectors including commercial airplanes, defense, space, and security systems, as well as global services. It is best known for its iconic aircraft such as the 737, 777, and 787 Dreamliner, which have helped connect the world’s cities and economies. Beyond aviation, Boeing leads ambitious projects in space travel, advanced robotics, and autonomous flight technologies.

Unlike many traditional manufacturing companies, Boeing evolved from the pioneering age of aviation and has remained a dominant force throughout the 20th and 21st centuries. Its legacy of innovation, high-performance engineering, and large-scale systems integration makes it a cornerstone of the global aerospace and defense industry.

History

Boeing was founded in 1916 by aviation pioneer William E. Boeing in Seattle, Washington. Originally a small manufacturer of seaplanes, the company played a significant role in both World Wars, supplying military aircraft that proved decisive in combat. Post-World War II, Boeing helped usher in the Jet Age with the launch of the 707, the first successful commercial jetliner.

Illustration 2: Boeing 707, was the first successful commercial jetliner.

Boeing’s commercial success soared with aircraft like the 737, 747, and 777, revolutionizing long-distance air travel. The 747, in particular, became a global icon and the world’s first wide-body “jumbo jet,” transforming air travel in the 1970s.

In 1997, Boeing merged with McDonnell Douglas, strengthening its position in the defense sector. The company also expanded into space systems, becoming a key contractor for NASA, including work on the International Space Station, Space Launch System, and Starliner crew capsule.

Despite facing challenges such as the 737 MAX crisis, global supply chain issues, and geopolitical headwinds, Boeing continues to be a vital force in aerospace innovation and global defense capabilities.

Operations and Production

- Portfolio

Boeing is one of the world’s leading aerospace companies, with core operations centered around the design, manufacture, and support of commercial airplanes, defense systems, satellites, and space exploration technologies.

Its flagship commercial aircraft include the 737, 747, 767, 777, and 787 Dreamliner families. With operations in over 65 countries and customers in more than 150, Boeing is one of the largest exporters in the United States.

Its operations are divided into three primary business units:

Illustration 3: A Boeing commercial plane landing.

Boeing Commercial Airplanes (BCA), which designs, assembles, and delivers aircraft to airlines and leasing companies. Boeing’s commercial aircraft families include 737 (The best-selling jetliner in history, primarily used for short- to medium-haul routes) and 787 Dreamliner (A long-haul, fuel-efficient wide-body aircraft made with composite materials).

Furthermore, it includes 777 and 777x ( Known for long-range and high-capacity, with the 777X featuring folding wingtips and the world’s most powerful jet engines), and 767 and 747-8 (used for both passenger and cargo operations, with the 747 being the iconic “Queen of the Skies).

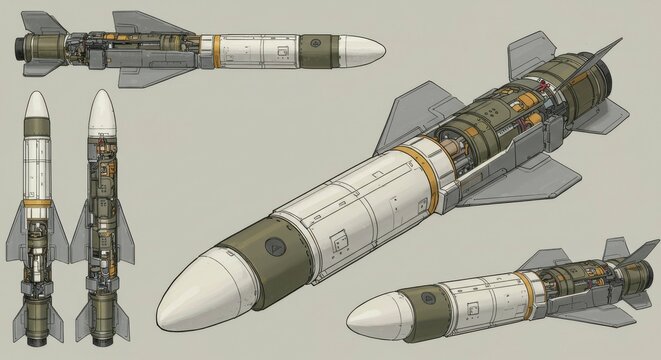

Illustration 4: A Boeing Spy plane

The second division of Boeing is Boeing Defense, Space & Security (BDS) which delivers products and services to government customers worldwide. This includes: Combat aircraft such as the F/A-18 Super Hornet and F-15EX Eagle II. Furthermore it also includes Rotary-wing platforms like the AH-64 Apache and CH-47 Chinook helicopters.

Missile defense systems, satellites, and space launch systems including the Space Launch System (SLS), the most powerful rocket NASA has ever built, is also part of the BDS division of Boeing.

The third division is Boeing Global Services (BGS) which offers logistics, maintenance, training, parts, and digital aviation services. BGS supports both commercial and defense customers with end-to-end lifecycle services

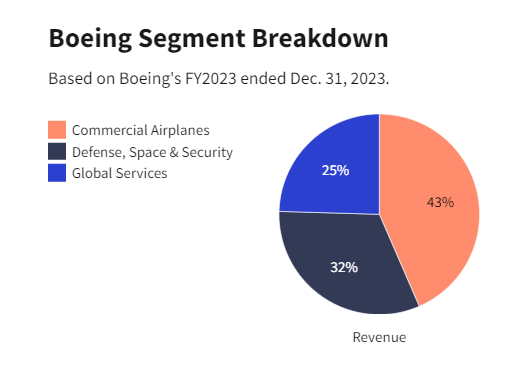

Illustration 5: Boeing revenue by segment

As can be seen from illustration 4, the largest segment for Boeing is commercial Airplanes at 43%. However, Defense, Space & Security also makes up a very big segment at 32% and Global Services at 25 %.

Boeing’s global manufacturing network includes major facilities in the U.S. (notably Everett and Renton, Washington; Charleston, South Carolina; and St. Louis, Missouri), along with significant operations in Australia, the U.K., Canada, and the Middle East.

- Technology and Space

Boeing plays a key role in space exploration and defense innovation. Through its work with NASA, Boeing helped develop the International Space Station (ISS) and is now working on the Starliner spacecraft, designed to transport astronauts to low Earth orbit.

In defense, Boeing is investing in autonomous systems such as the MQ-25 Stingray (an unmanned aerial refueling aircraft), loyal wingman drones, and space-based missile defense technologies. Boeing is also a key player in hypersonic weapons development and satellite constellations for secure communications and Earth observation

In the AI and digital space, Boeing uses advanced analytics, machine learning, and digital twins to optimize manufacturing, maintenance, and flight operations. he company’s “AnalytX” suite supports real-time fleet health monitoring, and its digital solutions are integrated into flight operations globally.

Illustration 6: Loyal Wingman, an AI-enabled drone developed in Australia, designed to operate alongside manned fighter jets.

Key Competitors

Boeing competes across various aerospace and defense sectors. Its competitors differ depending on whether the focus is on commercial aviation, defense contracts, or space exploration.

1. Commercial Aviation

Airbus SE is Boeing’s primary global competitor in commercial aircraft. Airbus’s A220, A320neo, and A350 families compete head-to-head with Boeing’s 737 MAX, 787, and 777 series.

COMAC is backed by the Chinese government, COMAC aims to reduce reliance on Western aircraft through its C919 and ARJ21 models.

Embraer is a leading manufacturer of regional jets, Embraer was once part of a failed merger with Boeing but remains a strong player in the 70–150 seat market.

2. Defense and Military Systems

Lockheed Martin, dominates in fighter aircraft and space systems with platforms like the F-35 and Orion.

Northrop Grumman is a competitor in autonomous aircraft, strategic bombers (B-21 Raider), and satellite systems.

Raytheon Technologies, provides engines (via Pratt & Whitney), avionics, and missile systems used in both commercial and military platforms.

3. Space and Emerging Tecg

SpaceX, Elon Musk’s company is a disruptive force in spaceflight, reusable rockets, and low Earth orbit (LEO) satellite networks (Starlink).

Blue Origin is competing with Boeing for lunar landers and suborbital space tourism.

Palantir, Anduril is tech firms, entering defense with AI-powered battlefield intelligence and surveillance systems.

Competitive Advantage

Boeing’s competitive advantage is rooted in its scale, technical expertise, and diverse operations across commercial aviation, defense, and space.

As one of the oldest and most recognized names in aerospace, Boeing benefits from a strong brand reputation built on decades of delivering reliable, high-performance aircraft and systems. This reputation fosters long-term trust and loyalty among airlines, governments, and space agencies worldwide.

Illustration 7: A Boeing Aircraft flying over the Alps

The company’s vertically integrated operations and vast global supply chain give it the ability to manufacture complex systems at scale, while also adapting to local markets and geopolitical shifts. Boeing’s Global Services division adds further value by offering lifecycle support, digital solutions, and predictive maintenance, deepening customer relationships beyond the point of sale.

Boeing’s broad product portfolio, from narrow-body jets and wide-body aircraft to fighter jets, satellites, and launch vehicles, allows it to spread risk and capture opportunities in multiple markets. During commercial downturns, its defense and space segments provide financial stability and continuity.

Innovation is another core strength. Boeing continuously invests in advanced manufacturing, autonomous systems, artificial intelligence, and sustainable technologies. Programs like the ecoDemonstrator test platform and partnerships in urban air mobility demonstrate its commitment to shaping the future of flight.

Illustration 8: A Boeing 777

Combined with its global presence and government partnerships, Boeing’s ability to integrate technology, scale, and service gives it a clear edge in a highly competitive industry.

Future Outlook

Boeing is entering a new growth phase as the aviation industry rebounds and global demand for commercial aircraft returns. The company is ramping up production of its 737 MAX and 787 models, while its defense and space divisions continue to secure major contracts, especially in the U.S. and Asia-Pacific.

Sustainability is at the core of Boeing’s future strategy, with investments in sustainable aviation fuels, electric and hydrogen propulsion, and next-generation aircraft. Its space ventures, including the Starliner and Space Launch System, position Boeing to play a major role in future space exploration. With a strong order backlog and focus on innovation, Boeing is well placed to lead the aerospace industry into the next era.

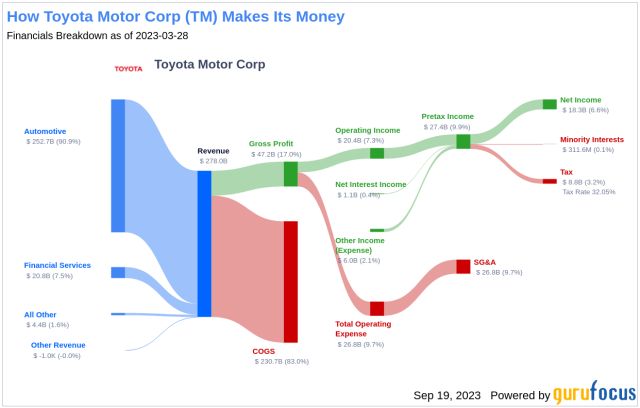

Stock Analysis

In this section we will analyze Toyota’s stock to see if it is a good stock to buy or not. Our philosophy is value investing meaning that we try to find good quality companies that are undervalued. However, we will give a holistic overview so all kind of investors with different philosophies can judge the stock for themselves.

Revenue and Profits

Illustration 9 and 10: Revenue of Boeing from 2009 to 2024

As shown in Illustrations 9 and 10, Boeing’s revenue trajectory has had sharp fluctuations rather than steady growth, with a particularly severe decline between 2018 and 2020. After peaking at around USD 101 billion in 2018, revenues plunged to approximately USD 58 billion by 2020, a staggering drop of over 40% in just two years. This steep decline, triggered by the grounding of the 737 MAX and compounded by the COVID-19 pandemic’s impact on global air travel, raising red flags for investors about Boeing’s operational resilience and crisis management.

While Boeing has made progress in recovering since then, revenues have not yet returned to pre-2018 levels as of 2024. The pace of recovery has been gradual, reflecting ongoing efforts to stabilize production, resolve supply chain issues, and rebuild customer confidence. Boeing’s focus on both commercial and defense segments provides some diversification, but its performance remains sensitive to the global aerospace market and regulatory developments.

Overall, Boeing’s financial performance over the past several years reflects a company navigating a complex recovery phase. The revenue volatility underscores the challenges faced during a turbulent period, but also highlights the potential for future growth as commercial aviation rebounds and new aircraft programs come online. For investors, this mixed picture calls for careful monitoring rather than a clear red or green flag.

Illustration 11 and 12: Net Income of Boeing from 2009 to 2024

Net income is a crucial metric to evaluate when determining whether a company is a worthwhile investment. It represents a company’s net profit or loss after accounting for all revenues, income items, and expenses, calculated as Net Income = Revenue – Expenses.

As seen in Illustrations 10 and 11, Boeing’s net income has shown significant volatility, with a sharp decline into negative territory from 2018 to 2020. This drop, driven by the 737 MAX crisis and the pandemic’s impact on air travel, marks a clear red flag, as profits fell even more steeply than revenues.

Although Boeing has made efforts to recover, net income remains inconsistent, reflecting ongoing challenges in production, regulation, and market demand. Unlike companies with steady profit growth, Boeing’s recent earnings instability signals elevated risk for investors focused on financial reliability.

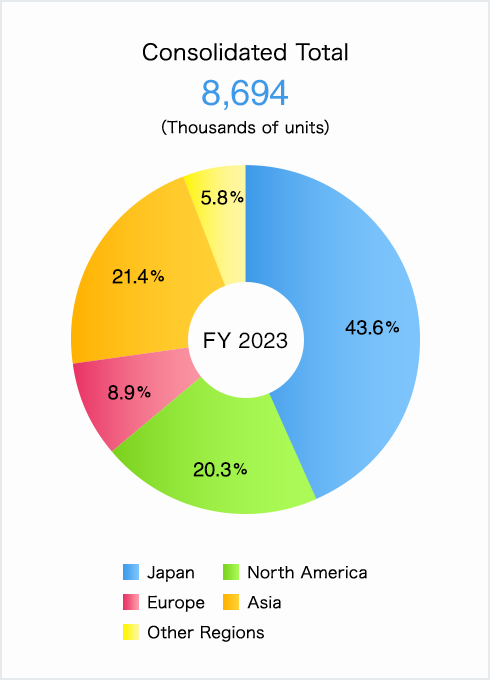

Revenue Breakdown

Illustration 13: Revenue breakdown of Boeing Co,

As shown in Illustration 13, Boeing’s core Commercial Airplanes segment remains its largest revenue contributor, typically accounting for around 40% of total revenue. This includes sales of aircraft such as the 737, 787, and 777 models to global airline customers and leasing firms. While historically a strong growth engine, this segment has experienced significant disruption since 2019 due to the 737 MAX grounding, COVID-19, and ongoing supply chain issues, resulting in elevated costs and production delays.

The Defense, Space & Security division, contributing around 35% of revenue, provides more consistent performance through multi-year government contracts for military aircraft, satellites, and surveillance systems. Boeing Global Services, making up roughly 26% of revenue, generates recurring income from maintenance, spare parts, pilot training, and digital analytics—supporting airline customers through fleet lifecycle services.

Boeing’s main costs that eats up most of it’s revenue is cost of goods sold (COGS) which remains very high, typically representing around 94.7% of revenue, reflecting the capital-intensive nature of aircraft production and frequent cost overruns related to rework and supply constraints. SG&A expenses covers global operations, customer support, and corporate functions while R&D expenses focuses on fuel efficiency, autonomous systems, digital engineering, and sustainable aviation, though these initiatives are still early in commercial impact. Emerging technologies such as space-based systems, electric propulsion, and advanced air mobility are strategically important but currently represent a small share of revenue. These areas are gradually expanding through joint ventures and government partnerships.

Overall, Boeing’s revenue structure reflects both high operating complexity and long-term diversification. While its defense and services businesses offer some financial stability, elevated costs and pressures in the commercial segment pose near-term challenges. The company’s ongoing investment in innovation underscores its long-term vision, but achieving margin recovery will depend on execution, supply chain normalization, and restoring commercial delivery volumes.

Earnings per Share

Illustration 14: Earnings per share for Boeing from 2009 to 2024

Earnings Per Share (EPS) is a key financial metric that measures a company’s profitability on a per-share basis. It indicates how much profit a company generates for each outstanding share of its stock, and is used to assess a company’s financial health, profitability, and potential for growth. In other words this metric can tell us how profitable the business is.

The EPS figure itself isn’t the primary focus for value investors, it can be 0.2 or 10, but what truly matters is the company’s ability to generate consistent earnings growth. A steadily increasing EPS over time signals strong financial health, profitability, and long-term value creation.

Boeing’s earnings per share from 2009 to 2025 shows a sharp decline from 17.85 in 2018 to -20.88 in 2020, marking a significant red flag. This drop was driven by the 737 MAX grounding and the pandemic’s impact on global aviation. While EPS has recovered somewhat in recent years, it remains below pre-crisis levels, reflecting continued cost pressures, supply chain issues, and production delays. The volatility in earnings highlights Boeing’s financial vulnerability during industry shocks and signals ongoing risk. For investors, this uneven trend raises concerns about near-term stability despite the company’s long-term strategic efforts. Furthermore, it had another significant drop from 2023 to 2024. These developments should be closely monitored by potential investors and are clear red flags.

Assets and Liabilities

Illustration 15 and 16: Assets and Liabilities for Boeing from 2009 to 2024

When evaluating a company as a potential investment, understanding its assets and liabilities is crucial. If a local business owner offered to sell their shop to you, one of the first questions. after determining its profitability, would be about its equity and assets. The same principle applies when assessing publicly traded companies like Boeing.

As shown in Illustrations 14 and 15, Boeing’s total assets reached approximately $156 billion in 2024, a figure that reflects the scale of its global operations. However, unlike the steady asset growth seen in some peers, Boeing’s asset base has fluctuated over the past decade due to write-downs, delivery delays, and program-related adjustments. While recent investments in next-generation aircraft and digital systems signal a forward-looking strategy, overall asset growth has been modest and uneven.

At the same time, Boeing’s total liabilities have increased substantially, rising to over $160 billion in 2024. Much of this is tied to debt issued during the pandemic to maintain liquidity and stabilize operations. While some leverage is expected in capital-intensive industries, Boeing’s high debt load combined with continued cash flow pressures raises concerns and big red flags about long-term financial flexibility and resilience. Investors should closely monitor Boeing’s ability to reduce debt and restore balance sheet strength in the coming years.

The critical issue for investors is whether Boeing can return to sustained profitability while managing its obligations. With thin margins and ongoing production costs, the company faces the challenge of generating sufficient free cash flow to reduce its liabilities without sacrificing investment in innovation and quality control. Failure to improve operating efficiency or deliver aircraft at scale could intensify financial strain.

Boeing’s cash on hand in 2024 remains relatively low compared to its long-term debt, which presents a red flag for liquidity. This imbalance could make it more difficult to weather unexpected disruptions or fund strategic initiatives without additional borrowing or asset sales. Investors should keep a close watch on Boeing’s cash generation and working capital management to assess its ability to support operations and repay obligations in the near term.

As seen in Illustration 15, Boeing’s total shareholder equity has turned negative in recent years, meaning its liabilities exceed its assets. This trend is a serious concern, as it indicates erosion of the company’s financial foundation and limited cushion against further losses. Negative equity can restrict financial flexibility and undermine investor confidence, especially if cash flow does not improve. While Boeing retains strong long-term potential in aerospace and defense, rebuilding equity will be essential to restoring investor trust and ensuring long-term financial stability.

Debt to Equity Ratio

Illustration 17 and 18: Debt to Equity ratio for Boeing from 2009 to 2024

The Debt-to-Equity (D/E) ratio is an important financial metric for assessing a company’s financial leverage and risk. It compares the amount of debt a company uses to finance its operations relative to its shareholder equity. A high D/E ratio suggests the company relies more heavily on debt, increasing financial risk, especially during periods of economic stress. In contrast, a lower D/E ratio implies more conservative financing through equity, offering greater financial stability but possibly slower expansion.

Legendary value investor Warren Buffett generally prefers a D/E ratio below 0.5. However, Boeing’s total shareholder equity turned negative in recent years, meaning its liabilities now exceed its assets. As a result, the D/E ratio is no longer a meaningful metric in the traditional sense, it is effectively undefined or extremely high. This situation signals a red flag, as it reflects the long-term financial strain caused by the 737 MAX crisis, pandemic-era losses, and the need for heavy borrowing to sustain operations. Restoring equity and reducing debt will be critical to improving financial health. Until then, the absence of a meaningful D/E ratio highlights the company’s reliance on debt financing and underscores the importance of disciplined cash flow management and margin recovery in the years ahead.

Price to earning ratio (P/E)

Illustration 19 and 20: Price to Earnings ratio for Boeing from 2009 to 2024

For value investors, one of the most critical metrics when evaluating Boeing’s stock is the price-to-earnings (P/E) ratio, as it helps assess whether the company is undervalued or overvalued. Even if a company has a strong brand and global footprint, paying too much for its stock can still result in poor returns. For example, imagine a business that earns $1 million annually, if offered to you for $1, it’s a steal. But if the owner asks $1 trillion, the profitability becomes irrelevant, the price is simply too high. The stock market works the same way: even good companies can be bad investments if bought at inflated prices.

Warren Buffett, a legendary value investor, generally prefers companies with a P/E ratio below 15, viewing them as attractively priced relative to earnings. In Boeing’s case, the situation is more complex. Due to multi-year losses from 2019 to 2021, Boeing’s P/E ratio has either been undefined or exceptionally high during those periods. As earnings have begun to recover, the P/E ratio remains volatile, sensitive to quarterly swings and investor sentiment. As of 2024, Boeing trades at a forward P/E ratio above 40, reflecting high expectations for recovery rather than current earnings strength.

For value investors, this elevated P/E signals caution. While Boeing’s long-term aerospace and defense prospects remain strong, the current valuation suggests that much of the recovery optimism is already priced in. Unless earnings normalize quickly and sustainably, the stock may offer limited margin of safety at current levels.

Price to Book ratio (P/B)

Illustration 21 and 22: Price to book ratio for Boeing from 2009 to 2024

Price-to-book value (P/B ratio) compares a company’s market value to its book value, calculated as total assets minus total liabilities. A low P/B ratio may indicate undervaluation, while a high ratio can signal overvaluation or strong growth expectations. Value investors, including Warren Buffett, often prefer P/B ratios under 1.5, ideally closer to 1.3, when seeking companies trading below their intrinsic asset value.

For Boeing, however, the P/B ratio is no longer meaningful, as the company’s shareholder equity has turned negative in recent years due to accumulated losses and rising liabilities. This means the book value per share is also negative, making the traditional P/B metric undefined.

Rather than suggesting undervaluation, this situation is a red flag, highlighting the weakened state of Boeing’s balance sheet. While Boeing continues to hold strategic value in commercial and defense aerospace, value investors are likely to remain cautious until equity becomes positive again and financial fundamentals stabilize.

Return on Investment (ROI)

Illustration 23 and 24: Return on Investment for Boeing from 2009 to 2024

For value investors, another essential metric when evaluating Boeing’s stock is Return on Investment (ROI), as it shows how efficiently the company uses its capital to generate profits. In simple terms, ROI measures the return earned relative to the capital required to operate the business. A company may have strong revenue, but if it requires heavy capital to generate modest profits, it may not be an efficient investment. For example, if two firms earn the same profit, but one uses half the capital to do so, it’s clearly more efficient. ROI helps investors identify companies that convert capital into returns effectively—a key consideration in capital-intensive industries like aerospace.

Boeing’s ROI has been highly volatile in recent years, and negative during 2017. While ROI has improved as earnings begin to recover, it still lags behind industry expectations. Boeing’s returns have been erratic, raising questions about capital efficiency and long-term value creation. As shown in Illustration 23 and 24, this inconsistent performance reflects the ongoing challenges Boeing faces in restoring operational stability, managing debt, and navigating cost overruns. For long-term investors, this is a cautionary signal, as it suggests that the company has yet to regain full control over its capital deployment. While Boeing remains a leader in aerospace innovation, meaningful improvement in ROI will be key to signaling that the company is delivering sustainable value from its significant investments. A 13% ROI for Boeing in 2024 is a good sign, especially considering its turbulent past few years. It suggests Boeing is becoming more efficient with its capital again. However, it should be assessed alongside other metrics, like cash flow, equity, debt levels, and order backlog, to judge whether the improvement is sustainable and investable.

Dividend

Illustration 25: Dividend Yield and dividend payout ratio from 2005 to 2025 for Boeing

Boeing has historically been a reliable dividend payer, with its annual dividend reaching as high as $2.06 per share in early 2020 and an average dividend yield around 2.5% over the past five years. However, Boeing suspended dividend payments in March 2020 amid financial challenges from the 737 MAX crisis and the COVID-19 pandemic. Since then, no dividends have been issued.

In 2024, Boeing reported a negative earnings per share (EPS) of approximately -$18.36, and while its dividend payout ratio would have been around 48% based on prior earnings patterns, the suspension means the actual payout ratio is effectively zero. This pause in dividends is a red flag for income-focused investors who value steady cash returns. That it has suspended dividends is a big red flag for investors.

Insider Trading

Illustration 26: Recent insider trading at yahoo, gathered from yahoo finance

Recent insider trading activity at Boeing has shown a significant increase in insider selling, which may raise concerns for investors. Between early and mid-May 2025, multiple senior executives, including Boeing’s Executive Vice Presidents and Presidents of major divisions sold substantial amounts of company stock, collectively worth several million dollars. While insider selling can be part of routine financial planning or diversification, the concentrated timing and volume of these sales are noteworthy.

Insider selling at this level can be interpreted as a potential red flag, as it may suggest that insiders have less confidence in the company’s near-term prospects or are taking advantage of current stock prices before possible declines. For value investors, such activity warrants closer scrutiny and signals the importance of monitoring Boeing’s forthcoming earnings results, operational updates, and market conditions.

Other Company Info

Founded in 1916, The Boeing Company is one of the world’s largest and most respected aerospace manufacturers, known for its commercial aircraft, defense systems, and space technologies. As of 2024, Boeing employs approximately 140,000 people globally, reflecting its extensive operations in manufacturing, engineering, research, and services. The company is publicly traded on the New York Stock Exchange (NYSE) under the ticker symbol BA and operates within the Industrials sector, specifically in the Aerospace & Defense industry.

Boeing is headquartered at 100 North Riverside Plaza, Chicago, Illinois, USA. As of 2024, the company has approximately 560 million shares outstanding, with a market capitalization of around $140 billion USD. For more information, visit Boeing’s official website: https://www.boeing.com.

Illustration 17: Number of employees and location of Boeing.

Final Verdict

The Boeing Company currently faces significant challenges that make it a risky investment, especially for value and income investors seeking stability. Despite being a major player in aerospace, Boeing’s financials reveal several red flags: the company has negative shareholder equity, high debt levels, and low cash reserves, which limit its financial flexibility and increase risk during downturns.

Boeing’s earnings have been volatile, and recent dividend cuts have diminished its appeal to income-focused investors. Ongoing production issues, delays, and market uncertainties further cloud the company’s near-term prospects. While Boeing is investing in innovation and defense contracts, these efforts have yet to translate into consistent profitability or a stronger balance sheet.

Overall, Boeing’s current financial health and operational risks suggest caution. It may not be suitable for conservative investors, and those considering it should be prepared for potential volatility and a prolonged recovery period. This makes Boeing a less attractive choice compared to more stable industry peers.