Introduction

Texas Instruments (TI) is a globally recognized American technology company specializing in the design and manufacturing of analog and embedded semiconductor solutions. Headquartered in Dallas, Texas, TI plays a crucial role in various industries, from consumer electronics to automotive, industrial automation, and communications. Unlike companies that focus primarily on digital processors, TI is a dominant force in the analog semiconductor market, producing essential components that enable power management, signal processing, and wireless connectivity.

Illustration 1: The logo of Texas Instruments which includes its famous outline of the state of Texas.

As one of the largest semiconductor manufacturers by revenue, Texas Instruments has maintained a strong market presence for decades. The company’s extensive product portfolio includes microcontrollers, power management chips, and data converters, which are integral to countless electronic devices. TI’s robust financial performance, strategic innovation, and commitment to efficient manufacturing make it a key player in the semiconductor industry.

History

Texas Instruments traces its origins back to 1930 when it was founded as Geophysical Service Incorporated (GSI), a company specializing in oil exploration technology. In 1951, it rebranded as Texas Instruments and shifted its focus to the emerging semiconductor industry.

TI’s breakthrough moment came in 1958 when engineer Jack Kilby invented the integrated circuit (IC), revolutionizing electronics and laying the foundation for modern computing. This innovation earned Kilby the Nobel Prize in Physics and cemented TI’s reputation as a semiconductor pioneer.

Throughout the 20th century, Texas Instruments played a pivotal role in advancing semiconductor technology. It became a leader in analog and embedded processing, developing industry-leading signal processors, power management chips, and automotive electronics. The company also ventured into consumer electronics, famously producing the first handheld calculator and early digital signal processors (DSPs).

By the 2000s, TI had streamlined its operations, focusing primarily on analog and embedded processing. This strategic move allowed the company to strengthen its competitive advantage in power-efficient, high-performance semiconductor solutions. Today, Texas Instruments continues to lead the analog semiconductor market, benefiting from its broad customer base, efficient manufacturing processes, and long product life cycles.

With a commitment to innovation and sustainability, TI invests heavily in research and development while expanding its global production capabilities. As industries increasingly rely on analog and embedded technologies, Texas Instruments remains well-positioned to drive growth and maintain its leadership in the semiconductor sector. In the stock market, Texas Instruments is often regarded as an indicator for the semiconductor and electronics industry as a whole, since the company sells to more than 100,000 customers.

Operations and Products

- Analog and Embedded Semiconductor Manufacturing

Texas Instruments (TI) is one of the world’s leading manufacturers of analog and embedded semiconductors, supplying essential components for industries such as automotive, industrial automation, consumer electronics, and communications. Unlike digital-focused semiconductor companies, TI specializes in analog chips and embedded processors that enable power management, signal processing, and wireless connectivity in electronic devices.

TI’s product portfolio includes power management integrated circuits (PMICs), data converters, amplifiers, sensors, and embedded processors like microcontrollers (MCUs) and digital signal processors (DSPs). These chips are fundamental to applications ranging from electric vehicles and renewable energy systems to medical devices and industrial automation.

A key differentiator for Texas Instruments is its in-house semiconductor manufacturing. The company operates its own wafer fabrication facilities (fabs), allowing greater control over production costs, quality, and supply chain stability. TI has invested heavily in advanced manufacturing processes, including the expansion of its 300mm wafer fabs, which provide significant cost advantages compared to traditional 200mm fabs.

- Emerging Technologies and Future Growth Areas

Texas Instruments is strategically expanding its capabilities in several high-growth markets, particularly in automotive and industrial sectors. The increasing adoption of electric vehicles (EVs) and autonomous driving has driven demand for TI’s power management and sensing technologies, making it a critical supplier for automakers and Tier 1 suppliers.

Illustration 2: A Texas Instruments BAII Plus Calculators. Calculators is one of many products TI offers.

In the industrial sector, TI plays a vital role in factory automation, robotics, and smart grid infrastructure, providing energy-efficient chips that optimize performance and reliability. With the rise of the Internet of Things (IoT), TI’s low-power wireless solutions, such as Bluetooth Low Energy and Wi-Fi connectivity chips, are widely used in smart home devices, wearables, and industrial IoT application

- Data-Centric AI and Embedded Processing Solutions

While Texas Instruments is not a major player in high-performance computing (HPC) or AI accelerators like Intel or NVIDIA, it provides critical support components for AI-driven applications. TI’s analog chips and embedded processors are used in AI-enabled edge devices, industrial sensors, and automotive AI systems.

Additionally, Texas Instruments continues to enhance its portfolio of automotive microcontrollers and ADAS (Advanced Driver Assistance Systems) components, helping power the next generation of AI-driven vehicle safety features. Its innovations in radar and sensor fusion technology are key to enabling semi-autonomous and autonomous driving capabilities.

Key Competitors

Texas Instruments operates in a highly competitive semiconductor industry, facing strong rivals across various market segments. Its key competitors include:

Analog Devices, Inc. (ADI) – One of TI’s primary competitors in the analog semiconductor market, Analog Devices specializes in high-performance signal processing, power management, and sensor technology. ADI competes with TI in sectors such as industrial automation, automotive, and communications.

Infineon Technologies – A major player in power semiconductors and automotive electronics, Infineon competes with TI in power management ICs, microcontrollers, and sensor technologies. Its strong presence in electric vehicles (EVs) and energy-efficient semiconductor solutions makes it a formidable competitor.

STMicroelectronics (ST) – STMicroelectronics is a key rival in embedded processing and analog semiconductors, offering a broad portfolio of microcontrollers (MCUs), sensors, and power management solutions. It competes with TI in automotive, industrial, and IoT applications.

NXP Semiconductors – NXP is a strong competitor in embedded processing and automotive semiconductors, particularly in ADAS (Advanced Driver Assistance Systems), vehicle networking, and secure connectivity solutions. Its MCUs and automotive processors rival TI’s offerings in the automotive sector.

Illustration 3: Outside Texas Instruments Headquarters

Competitive Advantage

One of Texas Instruments’ strongest competitive advantages is its vertically integrated manufacturing strategy, which includes in-house fabrication of semiconductors using 300mm wafer technology. Unlike many competitors that rely on third-party foundries, TI controls its entire production process, allowing for greater cost efficiency, supply chain stability, and quality control. The use of 300mm wafers provides a significant cost advantage over traditional 200mm wafers, reducing per-chip production expenses and enabling competitive pricing. This manufacturing efficiency helps TI maintain high profit margins while ensuring long-term supply reliability, especially in high-demand markets like automotive and industrial electronics.

Another key advantage is TI’s extensive and diverse product portfolio, which spans analog and embedded semiconductors, including power management ICs, data converters, amplifiers, sensors, and microcontrollers. These products are essential across a broad range of industries, from automotive and industrial automation to consumer electronics and communications. Unlike companies that focus primarily on cutting-edge digital processors, TI specializes in long product lifecycle semiconductors, ensuring sustained demand and reducing the risk of technological obsolescence. This strategic focus allows Texas Instruments to generate consistent revenue streams and maintain leadership in key analog and embedded markets.

Texas Instruments also benefits from a strong emphasis on research and development (R&D) and customer-driven innovation. The company invests heavily in advancing semiconductor technology, particularly in areas like power efficiency, sensor integration, and wireless connectivity. TI’s deep industry relationships and extensive technical support services enable it to tailor solutions to the evolving needs of its customers, fostering long-term partnerships with major players in the automotive, industrial, and communications sectors. Additionally, TI’s robust direct sales and distribution network ensures widespread availability of its products, reinforcing its leadership position in the semiconductor market.

Future Outlook

Texas Instruments is well-positioned for sustained growth as demand for analog and embedded semiconductors continues to expand across automotive, industrial, and IoT sectors. Its strong brand, cost-efficient manufacturing, and diverse product portfolio provide a solid foundation for long-term success.

TI stands to benefit from the increasing need for power management, signal processing, and energy-efficient semiconductor solutions, particularly in EVs, factory automation, and smart infrastructure. Its 300mm wafer technology ensures cost advantages and supply chain stability, reinforcing its market leadership.

Furthermore, TI’s continued investment in R&D, manufacturing expansion, and emerging markets presents significant growth opportunities. As industries shift toward electrification and automation, Texas Instruments remains a key player in shaping the future of semiconductor innovation.

Stock Analysis

In this section we will analyze Texas Instrument’s stock to see if it is a good stock to buy or not. Our philosophy is value investing meaning that we try to find good quality companies that are undervalued. However, we will give a holistic overview so all kind of investors with different philosophies can judge the stock for themselves.

Revenue and Profits

Illustration 4 and 5: Revenue for Texas Instruments from 2009 to 2024.

As shown in illustration 4 and 5, Texas Instruments (TI) has demonstrated strong long-term revenue growth, particularly from 2009 to 2022. The company’s focus on analog and embedded processing solutions has positioned it well in the semiconductor market, driving consistent gains for much of this period. TI benefited from increasing demand across industries, including automotive, industrial, and consumer electronics.

However, despite this long-term upward trend, TI has experienced notable periods of revenue decline, particularly from 2010 to 2013 and again from 2022 to 2024. The 2010–2013 downturn was largely due to restructuring efforts, including exiting the wireless business, and broader market fluctuations. While the company rebounded strongly afterward, the more recent 2022–2024 decline raises red flags for investors. This drop has been driven by weaker demand, inventory corrections, and heightened competition in the semiconductor space. However, all in all the general trend has been positive indicating increased revenue over time, but potential investors should monitor downturn carefully and especially the reasons for them.

Illustration 6 and 7: Net Income for Texas Instruments from 2009 to 2024

Net income is a crucial metric to evaluate when determining whether a company is a worthwhile investment. It represents a company’s net profit or loss after accounting for all revenues, income items, and expenses, calculated as Net Income = Revenue – Expenses.

The net income of Texas Instruments is a red flag as it has been both volatile and on a strongly negative trend in the last couple of years, particularly from 2022 to 2024. This decline is driven by several factors, including weakening demand in key markets, inventory corrections, higher operational costs, and increased competition from other semiconductor manufacturers. Additionally, macroeconomic uncertainties and fluctuations in the semiconductor cycle have further pressured profitability. In 2024, net income saw a significant decline, raising concerns for potential investors about TI’s ability to maintain strong margins and competitive positioning. Given this negative trend, investors should closely monitor TI’s financial performance to assess whether the company can stabilize profitability and return to growth. However, all in all the general trend from 2009 to 2022 has been generally positive which indicates that the profitability over time for the company is usually positive, and that if past gains is an indicator for future gains, it will develop in a positive direction in the future again.

Revenue breakdown

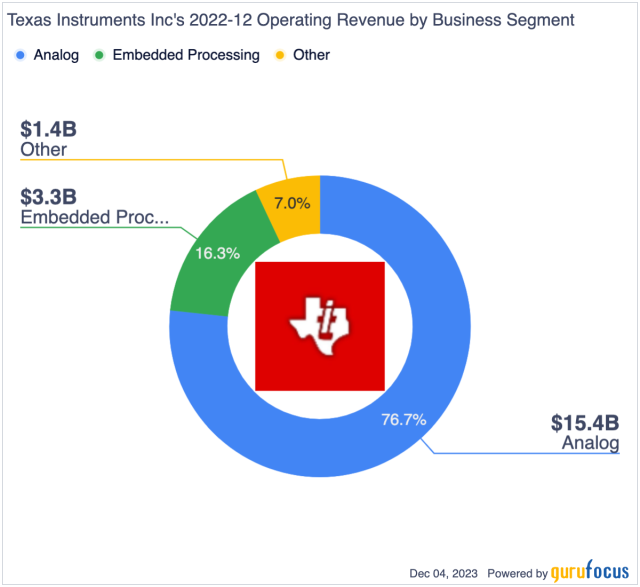

Illustration 8 and 9: Revenue breakdown for Texas Instruments

The Analog segment is Texas Instruments’ largest revenue driver, contributing approximately 75-80% of total revenue. This segment includes power management, signal chain, and high-performance analog chips used in automotive, industrial, communications, and personal electronics. TI has a strong market position in analog semiconductors, but it faces increasing competition from companies like Analog Devices and Infineon. While demand has historically been strong, recent downturns in the semiconductor cycle have impacted growth.

This segment accounts for around 15-20% of TI’s revenue, focusing on microcontrollers and processors used in industrial automation, automotive systems, and communications equipment. The push toward automation and the growing electrification of vehicles have supported long-term growth in this segment. However, macroeconomic headwinds and inventory corrections have created challenges in recent years, contributing to the revenue decline from 2022 to 2024.

The remaining 5% of TI’s revenue comes from legacy businesses and other semiconductor products. While this segment is not a primary growth driver, it provides additional diversification. However, despite strong historical performance, Texas Instruments has faced a concerning decline in revenue and net income from 2022 to 2024. The company’s net income dropped from $8.7 billion in 2022 to $6.3 billion in 2023, with further declines expected in 2024 due to softening demand, rising costs, and inventory corrections. Given these financial pressures, investors should carefully monitor TI’s ability to recover and sustain long-term profitability

As seen in Illustration 8, a significant portion of Texas Instruments’ revenue is allocated to the cost of goods sold (COGS), which is expected for a semiconductor company. However, COGS does not account for as large a percentage of revenue as one might anticipate, indicating strong gross margins.

In addition, Texas Instruments invests heavily in research and development (R&D), which is a positive signal for potential investors. This commitment to innovation helps the company maintain a competitive edge in analog and embedded processing markets, ensuring long-term growth opportunities.

Overall, Texas Instruments’ revenue breakdown and expense structure present a favorable outlook for investors. The company’s diversified revenue streams and efficient cost management allow it to retain a substantial portion of earnings as net profit, reinforcing its position as a financially stable and well-managed semiconductor leader.

Earnings per Share (EPS)

Illustration 10: EPS for Texas Instruments from 2009 to 2024

Earnings Per Share (EPS) is a key financial metric that measures a company’s profitability on a per-share basis. It indicates how much profit a company generates for each outstanding share of its stock, and is used to assess a company’s financial health, profitability, and potential for growth. In other words this metric can tell us how profitable the business is.

The EPS figure itself isn’t the primary focus for value investors—it can be 0.2 or 10, but what truly matters is the company’s ability to generate consistent earnings growth. A steadily increasing EPS over time signals strong financial health, profitability, and long-term value creation.

Texas Instruments’ earnings per share (EPS) performance from 2009 to 2023 reflects a generally strong long-term trend, but recent years have shown a concerning decline. From 2009 to 2022, TI consistently grew its EPS, reaching a peak of $9.41 per share in 2022. However, in 2023, EPS dropped to $7.07, and further declines are expected in 2024 due to weakening demand, inventory corrections, and increased operational costs.

This downward trend is a red flag for investors, as it indicates that TI is struggling to maintain profit growth despite its historically strong revenue performance. However, its strong historical performance is a green sign since it shows the ability to maintain and grow profit over time. Potential Investors should in all case monitor the EPS of TI closely for sudden changes.

Assets and Liabilities

Illustration 11 and 12: Assets and Liabilities for Texas Instruments from 2009 to 2024

When evaluating a company as a potential investment, understanding its assets and liabilities is crucial. If a local business owner offered to sell their shop to you, one of the first questions—after determining its profitability—would be about its equity and assets. The same principle applies when assessing publicly traded companies like Texas Instruments.

As shown in Illustrations 11 and 12, Texas Instruments has a substantial asset base, totaling $35.5 billion in 2024. While this is lower than its competitors in the semiconductor industry, the steady asset growth over time from 2009 to 2024 is a positive sign, indicating that the company is expanding its operations, investing in new technologies, and strengthening its market position. A growing asset base often reflects a company’s ability to scale its business, acquire new projects, and improve its production capacity, which is particularly important in the competitive industry Texas Instruments is in.

At the same time, Texas Instruments’ total liabilities have also increased, rising from $2.3 billion in 2009 to $18.6 billion in 2024. . While such a sharp increase in debt might raise concerns for some investors, it is not necessarily a red flag given the nature of the semiconductor industry. Significant capital expenditures are often required for research and development, as well as for building and upgrading manufacturing facilities to remain competitive. TI has consistently invested in manufacturing capacity expansion, research and development, and supply chain resilience, which require significant capital expenditures. Unlike some competitors, TI follows a capital-efficient strategy, with a focus on maintaining strong free cash flow and shareholder returns while investing in long-term growth. However, investors should closely monitor TI’s debt levels and its ability to manage liabilities effectively, especially as profitability has declined in recent years. Ensuring that debt remains manageable and does not hinder future financial stability will be crucial for the company’s long-term success.

The key factor for investors is whether Texas Instruments can effectively manage its debt while maintaining strong revenue and profitability. If the company can generate consistent cash flow and sustain high demand for its products and services, its rising liabilities may not be a major issue. However, if debt levels continue to grow faster than revenue or profits, it could indicate financial strain, making it important for investors to monitor the company’s ability to service its obligations while maintaining profitability.

The cash on hand for Texas Instruments is a red flag for potential investors, as the company has $7.5 billion in readily available cash as of 2024. This is lower than expected, given the company’s large-scale operations and significant capital expenditures. In addition, its cash on hand is significantly lower than its long-term debt of $12.8 billion as of 2024, which indicates a potential liquidity risk. This imbalance could limit Texas Instrument’s ability to respond to unforeseen market challenges or invest in future growth opportunities without relying heavily on additional debt.

As seen in Illustration 12, Total Shareholder Equity—calculated as total assets minus total liabilities—has consistently grown over the past 14 years. This is a positive indicator for potential investors, as it suggests that Texas Instruments is building value over time rather than eroding its financial foundation. A steadily increasing shareholder equity indicates that the company’s assets are growing at a faster rate than its liabilities, which is a green flag for financial health. This trend suggests that Texas Instruments is successfully expanding its operations while maintaining a solid balance sheet. Additionally, rising equity provides a buffer against financial downturns, making the company more resilient in times of economic uncertainty. However, investors should also consider how this growth is achieved—whether through profitable operations or increased debt financing—to fully assess the sustainability of this trend. The recent dip down in total shareholder equity from 2023 to 2024 should also be strongly monitored to make sure it is not the start of a stronger downwards trend.

Debt to Equity Ratio

Illustration 13 and 14: Debt to Equity ratio for Texas Instruments from 2009 to 2024

The Debt-to-Equity (D/E) ratio is an important financial metric for assessing a company’s financial leverage and risk. It compares the amount of debt the company uses to finance its operations relative to its shareholder equity. A high D/E ratio suggests that the company relies more heavily on debt to fuel growth, which could increase financial risk, especially during economic downturns when managing debt obligations becomes more challenging. In contrast, a lower D/E ratio indicates that the company is primarily financed through equity, reducing financial risk but potentially limiting its ability to rapidly expand.

Legendary value investor Warren Buffett generally prefers a ratio below 0.5. Texas Instrument’s D/E ratio is currently above that and has been on the rise from 2009 to 2020, which indicates increasing reliance on debt financing over the past decade. This rising trend could suggest concerns about the company’s financial leverage and potential risks in managing its debt load. However, since 2020, it has had a downturn, which indicates a shift towards a more conservative approach in its capital structure. This decline could signal efforts by TI to reduce its debt and improve financial stability, making it potentially more appealing to long-term investors concerned about excessive debt. The D/E ratio of Texas Instruments have also been volatile indicating that while the company generally maintains a conservative approach to debt, fluctuations suggest occasional periods of increased financial leverage, which could pose risks if not managed effectively. This is not a red flag as long as the company don’t become too reliant on debt, especially the combination of increased debt and reduced revenue/profits should be strongly watched for.

Price to earnings ratio (P/E)

Illustration 15 and 16: P/E ratio for Texas Instruments from 2010 to 2025

For value investors, one of the most critical metrics when evaluating Texas Instrument’s stock is the price-to-earnings (P/E) ratio, as it helps assess whether the company is undervalued or overvalued. Even if a company has strong financials, purchasing its stock at a high price can lead to poor returns. For example, imagine a business generating solid profits of $1 million per year. If the owner offers to sell you the business for just $1, it would be an incredible deal. But if the owner asks for $1 trillion, even though the business is profitable, the price would be absurdly overvalued. The stock market works similarly—companies can be priced cheaply on some days and excessively expensive on others.

Warren Buffett, a legendary value investor, typically considers stocks with a P/E ratio of 15 or lower as “bargains.” A high P/E ratio suggests that investors are paying a premium for the company’s earnings, expecting significant growth. However, this also indicates that the stock is expensive relative to its earnings, which can be a red flag for value investors. The P/E of Texas Instruments has fluctuated widely in recent years, but it has over time grown from 10,15 in 2010 to 34,8 in 2025. Considering the historical prices of TI, this is also a bit high, which suggests that the stock may be overvalued relative to its fundamentals. A P/E ratio of 34.8 in 2025, combined with declining revenue and profits and increased competition, indicates that investors may be pricing in future growth expectations that might not be justified by recent financial performance. For value investors, such a high P/E ratio, especially during a period of financial weakness, is a red flag, suggesting that TI might be overpriced compared to its intrinsic value. Investors should carefully assess whether TI can justify its high valuation through future earnings growth or whether it faces risks of a price decline.

Price to book value (P/B ratio)

Illustration 17 and 18: Price to book value for Texas Instruments from 2010 to 2025.

Price-to-book value (P/B ratio) is a financial metric used to compare a company’s market value (its stock price) to its book value (the net asset value of the company, calculated as total assets minus total liabilities). The P/B ratio is calculated by dividing the current share price by the book value per share. A lower P/B ratio suggests that the stock may be undervalued, as investors are paying less for the company’s assets than their actual worth. Conversely, a high P/B ratiomay indicate that the stock is overvalued, or that investors expect high growth in the company’s future earnings. The P/B ratio is often used by value investors to assess whether a stock is trading at a fair price based on its underlying assets. Legendary Investor Warren Buffet prefers company’s with P/B lower than 1.5 and often buys around 1.3 or lower.

The price-to-book (P/B) ratio of Texas Instruments is a red flag, as it is significantly higher than its competitors and well above the levels that Warren Buffett typically considers undervalued. This suggests that the company may be overvalued relative to its book value, meaning investors are paying a high premium for its assets. Furthermore, the overall upward trend in the P/B ratio, despite a decline from 2021 to 2024, indicates that investor sentiment remains strong even as revenues and profits have weakened. This could suggest over-optimism about TI’s future growth or a disconnect between its stock price and its fundamental value. If profitability continues to decline while the P/B ratio remains high, it could signal a risk of overvaluation and potential price corrections. Investors should carefully assess whether the company’s financial performance can justify its high valuation or if the stock is trading at an unsustainable premium.

Dividend

Illustration 19: Dividend Yield and dividend payout for Texas Instruments from 2005 to 2025

Texas Instruments has established itself as a reliable dividend payer in the semiconductor industry, offering an annual dividend of $5.21 per share in 2025. This reflects the company’s commitment to returning capital to shareholders while maintaining financial stability. TI has a strong history of steady dividend growth, consistently increasing payouts since 2004, making it a favorable choice for income-seeking investors even during economic downturns.

However, there are concerns regarding TI’s dividend yield, which declined to approximately 2.8% in 2024. While the company has consistently raised its dividend over the years, slowing earnings growth and increased capital expenditures could impact future increases. Given TI’s significant investments in manufacturing expansion and R&D, there is a risk that dividend growth may slow or become less sustainable if profitability continues to decline.

✅ Green Flags:

✔ Strong Dividend History: Texas Instruments has a proven track record of dividend payments and consistent increases, making it attractive to long-term income investors.

✔ Healthy Payout Ratio: TI maintains a payout ratio around 50-60%, which suggests dividends remain sustainable under current conditions.

🚩 Red Flags:

⚠ Declining Dividend Yield: Despite rising payouts, TI’s dividend yield has dropped, signaling that stock price growth has outpaced dividend increases.

⚠ Capital-Intensive Expansion: Large investments in new manufacturing facilities and research may limit future dividend growth or put pressure on cash flow.

Insider Trading

Illustration 20: Last couple of insider trading at Texas Instruments

As shown in illustration 20, the insider trading at Texas Instrument is a red flag for potential investors as a lot of insiders are currently selling their shares in Texas Instruments. Insider selling has outpaced buying, which could be a red flag if it indicates a lack of confidence in the company’s future growth. Furthermore, the people selling stocks are the chairman of the board and high ranking officers which should be especially concerning. In addition, considering the downturn in revenue in the last couple of years this could indicate that the downwards trend could continue and that insiders don’t trust the company to turn the trend around in recent future.

Other Company Information

Founded in 1930, Texas Instruments (TI) is a global leader in semiconductor manufacturing, particularly known for its analog and embedded processing chips. As of 2024, TI employs approximately 33,000 people, reflecting a relatively stable workforce compared to previous years. The company is publicly traded on the NASDAQ under the ticker symbol TXN and operates within the Technology sector, specifically in the Semiconductors industry. As of 2024, TI has approximately 910 million shares outstanding, with a market capitalization of around $140 billion USD.

Texas Instruments is headquartered at 12500 TI Boulevard, Dallas, Texas, 75243, United States. For more information, the company’s official website is www.ti.com.

Final Verdict

Investing in Texas Instruments Incorporated (TI) offers a compelling mix of stability and strategic positioning. TI is a leading analog and embedded semiconductor company, known for its strong operational efficiency and long-standing commitment to returning capital to shareholders. The company has raised its dividend for 20 consecutive years, with a current dividend yield of approximately 2.9% and a payout ratio near 65%, signaling healthy cash flow management. TI’s focus on industrial and automotive markets—which together make up nearly 80% of its revenue—offers steady long-term growth potential driven by increasing chip content in everyday devices.

However, caution is still warranted. TI’s revenue declined about 10% year-over-year in 2024, reflecting cyclical headwinds and weaker demand in some end markets. Moreover, the stock trades at a P/E ratio of roughly 23, which may be considered high relative to historical averages, especially in a softening macro environment. Competition from firms like Analog Devices and Infineon is also intensifying.

Leave a Reply