Introduction

The decision between starting your own business or investing in stocks is one of the most critical financial choices an individual can make. Both paths offer unique opportunities for wealth creation, but they also come with distinct risks and challenges. This article aims to explore all the possible factors to consider when choosing between entrepreneurship and stock market investing, including risk tolerance, capital availability, time commitment, skillset, personal goals, and economic conditions.

Understanding the Fundamentals

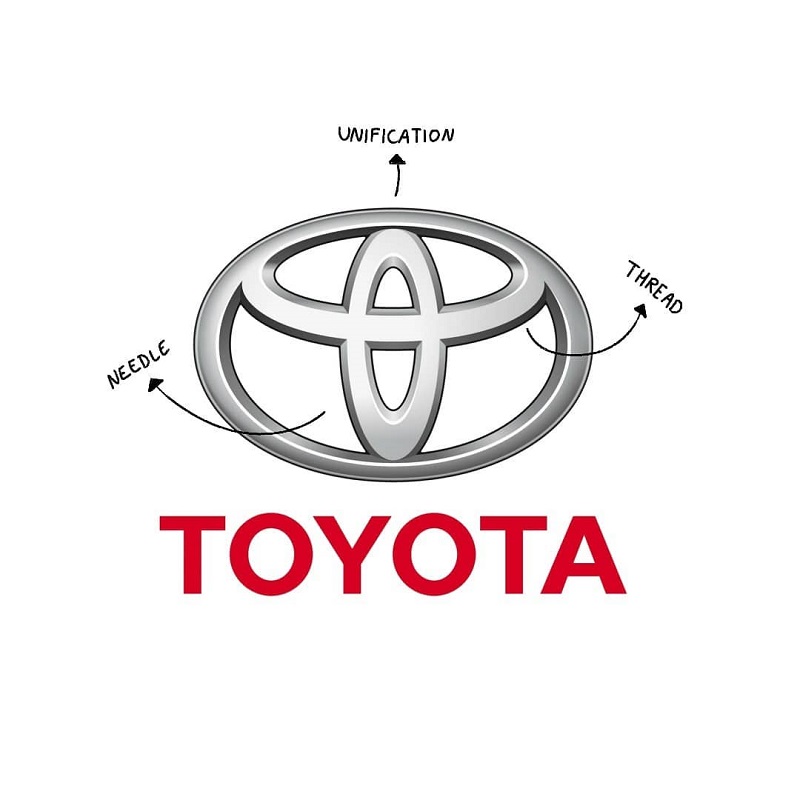

Before diving into the key factors, let’s define each option clearly:

- Starting a Business involves creating and managing your own company, that offers goods or services. It requires a business idea, operational planning, marketing, and a long-term commitment to growth and management.

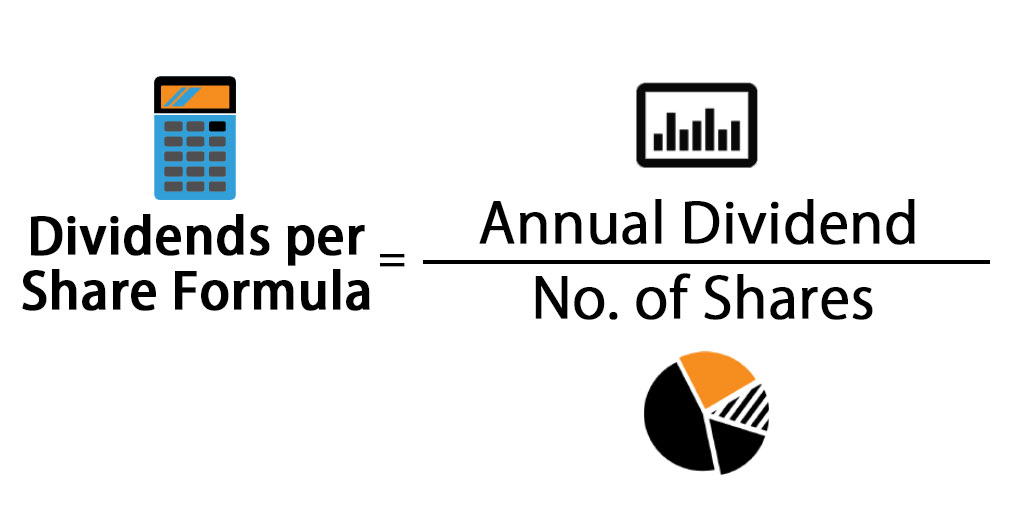

- Investing in Self-Picked Stocks means selecting and purchasing shares of companies based on research and analysis, aiming for capital appreciation, dividends, or both. This can be everything from small penny stocks to the stocks of some of the biggest and most well established companies in the world.

Investing in stocks and starting a business both involve risk, research, and the potential for long-term wealth, but they differ in control and involvement. Investors rely on companies to grow their money, often passively, while entrepreneurs actively build and manage their businesses.

Both require patience, strategy, and the ability to handle uncertainty, but a business offers more control over success, whereas stocks provide diversification and liquidity. Ultimately, one is about owning a piece of someone else’s success, while the other is about creating your own. Each approach can lead to financial success but in very different ways. The choice depends on individual circumstances, risk appetite, and long-term objectives

1. Risk Tolerance

Starting a Business: Involves high risk, with a significant percentage of startups failing within the first few years. Risks include financial loss, market competition, operational challenges, and economic downturns.

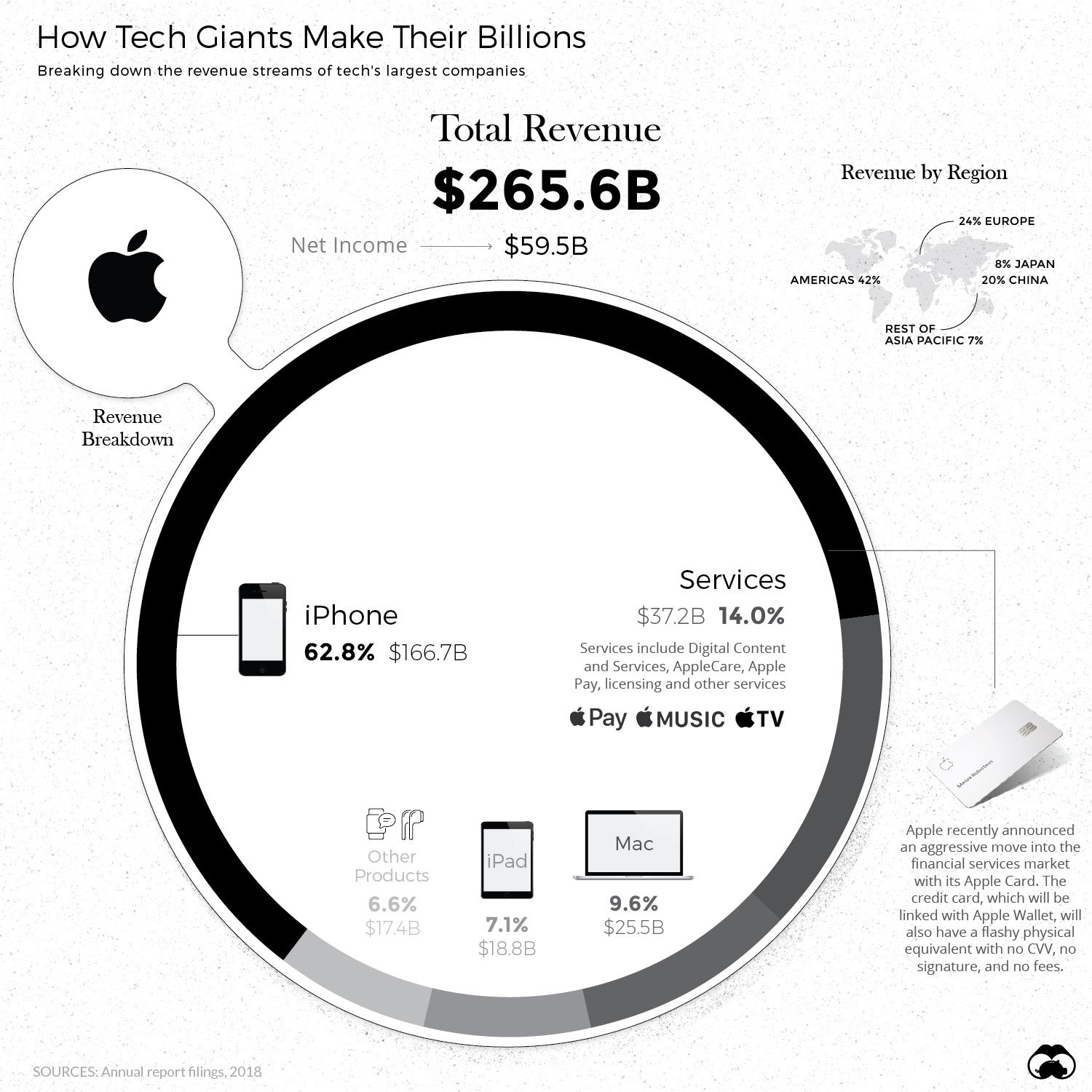

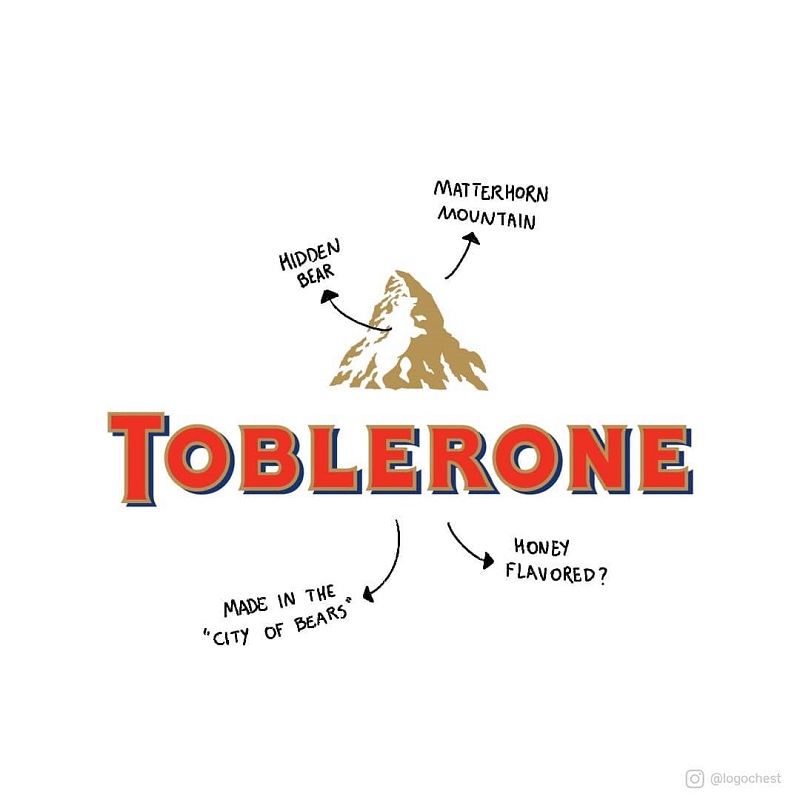

Illustration 1: If entrepreneurship or the stock market is the best alternative depends on how much risk you are willing to take on.

The failure rate if newly started and established companies is quite high. After the first year, about 20% of new businesses fail. After 3 years: Around 45% of businesses fail (~55% survive). After 5 years: Roughly 50%–60% of businesses fail (~40%–50% survive). And after 10 years: Around 70%–90% of businesses fail.

It’s important to note that these figures only reflect business survival rates, not actual success. Among the companies that avoid bankruptcy, 80–90% remain small, with modest profits or just breaking even. Around 5–10% achieve moderate success, growing into stable mid-sized businesses, while 1–5% experience significant growth, becoming highly profitable and expanding nationally or internationally. Fewer than 0.1% reach unicorn status, with a valuation of $1 billion or more. Moderate is here defined as a company that has a net profit of USD 500 000 to USD 20 000 000.

Investing in Stocks: Stock market investments also carry risks, such as market volatility, economic downturns, and company-specific risks. However, diversified investing can help mitigate these risks.

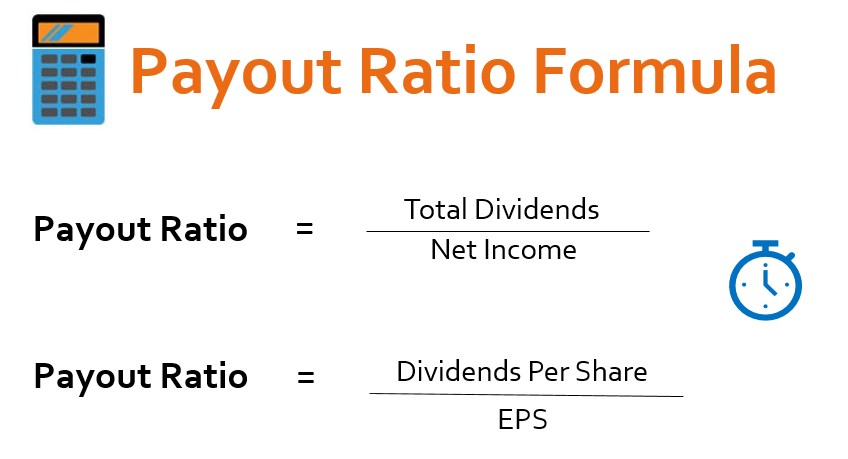

The average person in stock investing tends to underperform the market, with individual investors typically achieving returns around 3%–5% annually, while the S&P 500 historically averages 7%–10% per year, adjusted for inflation. Many investors struggle with poor timing, often buying high and selling low, or making emotional decisions during market volatility. Active traders, trying to pick stocks or time the market, often face higher fees and taxes, which further erode returns. In contrast, those who invest passively in diversified index funds generally align more closely with the market’s long-term average returns, making it a more reliable strategy for most investors.

However, the average stock investor do get a much better return on money, on average, compared to an entrepreneur.

Illustration 2: If you are good with Uncertainty, entrepreneurship can be for you.

Key Consideration: If you have a high-risk tolerance and are comfortable with uncertainty, entrepreneurship could be a good fit. However, if you prefer more calculated risks with the option for diversification, investing in stocks might be the better route. Both options involve risk, but the right choice depends on your personal risk tolerance. Remember, the higher the risk, the greater the potential return—whether you’re choosing stocks or deciding whether to start a business.

2. Capital Requirements

Starting a Business: Starting a business requires significant upfront investment for product development, inventory, marketing, and operational costs. These initial expenses can be substantial, as you’ll need to cover everything from creating your product or service to securing a physical location or paying for website hosting. Rent, employee salaries, and advertising campaigns can also add up quickly. Many entrepreneurs underestimate the financial strain at the beginning, and without enough funding, businesses can easily fail.

You’ll need to save up enough money to cover all these costs before you even start generating income. Inventory purchases, production costs, and operational overheads are not cheap, and it’s easy to feel overwhelmed by the scale of these expenses. If you don’t have the right resources or backup funding, it can be difficult to maintain momentum during the early stages, especially if cash flow is slow. Unlike investing in stocks, which can be done with a relatively small initial capital, starting a business demands a much higher upfront commitment.

Illustration 3: Starting a Business often requires saved capital.

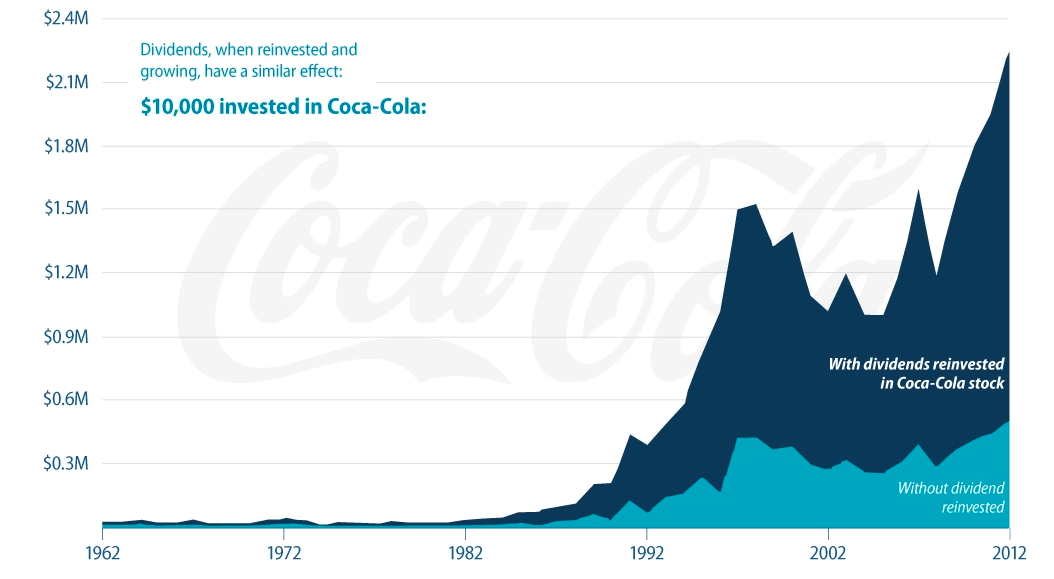

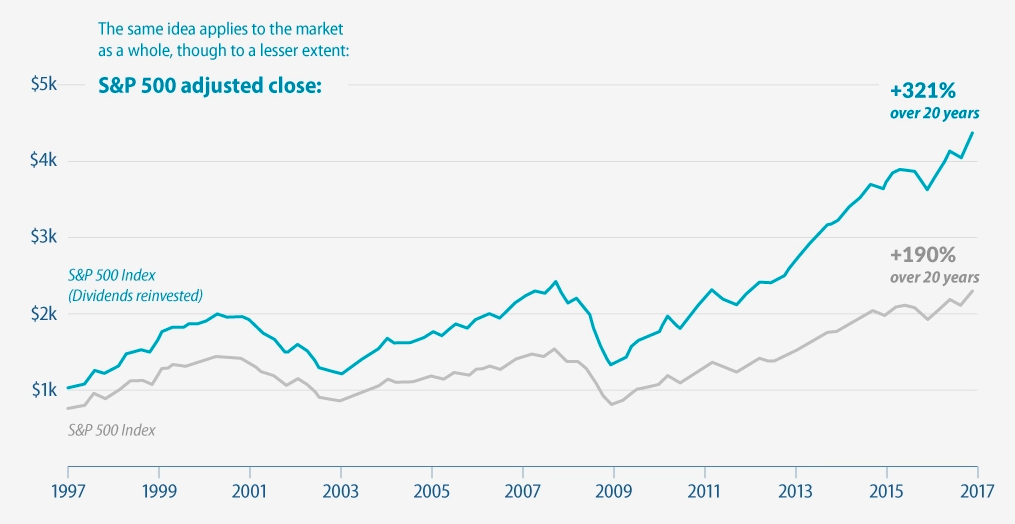

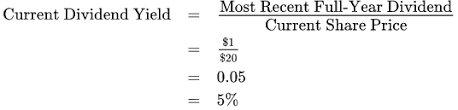

Investing in Stocks: Requires less capital initially. With as little as a few hundred dollars, you can start investing in stocks. While the capital required to start investing in stocks is relatively low, it’s important to remember that achieving significant returns often requires a long-term commitment and a consistent investment strategy. While you can start small, many investors opt to increase their capital gradually, taking advantage of compounding returns. However, it’s essential to be mindful of the costs involved, such as trading fees, commissions, or taxes on dividends and capital gains, which can eat into your profits.

Key Consideration: If you have substantial capital and access to funding, starting a business may be feasible. If capital is limited, stock investing offers a lower barrier to entry.

3. Time Commitment

Starting a Business: Starting a business requires full-time dedication, particularly in the early stages when the foundation is being built. Running a business demands long hours, as entrepreneurs must juggle various tasks, from product development and marketing to managing finances and customer service. It’s a constant cycle of problem-solving and adapting to unforeseen challenges, whether it’s adjusting to market changes, troubleshooting operational issues, or making tough decisions. The ability to remain flexible and resilient is crucial, as the business landscape can shift quickly and often requires entrepreneurs to pivot or refine their approach to stay competitive.

On average, entrepreneurs tend to work 8 to 12 hours a day. In the early stages of a business, this can often stretch beyond 12 hours a day, especially when the entrepreneur is handling multiple roles like marketing, customer service, and operations. As the business matures and more employees are hired, the hours may become more manageable, but many entrepreneurs still put in long days, sometimes working evenings or weekends to stay on top of tasks and ensure the business continues to grow.

Illustration 4: Starting a Business can take significant time.

Investing in Stocks: While active trading requires significant research, long-term investing can be more passive. Stock investing generally requires fewer hours per day compared to running a business. For most investors, he daily time commitment can be quite minimal. On average, investors may spend 30 minutes to an hour a day checking their portfolios, staying updated on market trends, or reviewing the performance of specific stocks.

For those actively trading or managing their investments, it could require more time, possibly 2 to 4 hours a day, particularly if they are making frequent trades or conducting in-depth research. However, stock investing doesn’t typically demand the constant attention that a business requires, and the time commitment can be adjusted based on the investor’s approach—whether it’s passive, active, or a mix of both. If you are picking your own stock, conducting fundamental analysis of all the different companies could take significant time.

Key Consideration: If you prefer flexibility and passive income, stock investing may be a better choice. If you are passionate about building something and willing to dedicate years to it, entrepreneurship might be the way to go.

4. Skillset and Expertise

Starting a Business: Starting a business requires a broad set of skills, including knowledge of business operations, finance, marketing, management, and industry-specific expertise. Entrepreneurs need to understand how to efficiently manage resources, create a profitable business model, and navigate regulatory requirements. Financial knowledge is crucial for managing cash flow, budgeting, and ensuring the business remains solvent. Additionally, marketing and management skills are essential for attracting customers and leading a team, while industry-specific knowledge helps ensure the business can compete effectively in its sector.

Investing in Stocks: Investing in stocks requires a solid understanding of financial markets, stock valuation, economic trends, and risk management. Investors need to assess a company’s financial health, understand how market forces can affect stock prices, and evaluate the potential for future growth. They must also manage risk, which involves diversifying investments and understanding how broader economic conditions can impact their portfolio. Staying informed about global and local market trends, as well as financial reports, is key to making informed investment decisions.

Illustration 5: Expertise is an important factor to take into account.

Key Consideration: f you have strong business acumen and leadership skills, running a business might be a better fit for you. Entrepreneurship allows you to directly apply your skills in management, problem-solving, and decision-making. On the other hand, if you enjoy analyzing companies, financial data, and understanding market trends, stock investing could be a better option. Both paths require a keen understanding of numbers, but the level of involvement and the type of expertise needed differ significantly.

5. Potential Returns and Scalability

Starting a Business: Starting a business can offer unlimited earnings if successful, but profits depend heavily on execution, market demand, and the scalability of the business model.

Investing in Stocks: Stocks can also provide unlimited earnings, depending on the type of stocks and the performance of the companies you invest in. While stock market returns are generally more predictable, with historical averages around 7-10% annually, certain high-growth stocks or successful investments can lead to substantial, even life-changing returns. However, like any investment, there is risk involved, and not all stocks will provide the same level of growth.

Illustration 6: Scalability is an important factor to take into account.

Key Consideration: If you are willing to take on the risk for potentially higher earnings, starting a business could be ideal. However, if you prefer steady growth with more predictable returns, investing in stocks may be the better choice, with the opportunity for unlimited earnings depending on your investment choices.

6. Control and Decision-Making

Starting a Business: Starting a business offers full control over decision-making, allowing entrepreneurs to shape the direction of the company, set goals, and implement strategies. However, this autonomy comes with the responsibility for both the successes and failures of the business. Entrepreneurs must navigate challenges, adapt to changes, and make critical decisions across all aspects of the business, from operations to finances and marketing.

It also means that entrepreneurs will have to face a lot more stress and work, as mentioned, longer hours. They also need to have a much broader skillset, taking decision in everything from marketing issues to supply chain issues.

Investing in Stocks: When investing in stocks, you have control over which stocks to buy and sell, but you don’t have direct influence over the day-to-day operations or strategic decisions of the companies in which you invest. Your role is limited to making investment decisions based on research and analysis, leaving the management and execution to the company’s leadership team. While you can vote on certain company matters (in the case of voting shares), your impact on decisions is minimal compared to owning and running a business.

Key Consideration: If you value autonomy and want to have complete control over your decisions and the direction of a business, entrepreneurship offers that control. On the other hand, if you prefer to invest in established companies and trust in their management teams to execute plans, stock investing is a good option, allowing you to benefit from their expertise without the responsibility of day-to-day management.

7. Market and Economic Conditions

Starting a Business: Market trends, customer demand, and overall economic conditions play a significant role in determining the viability and success of a business. If the market is favorable, with strong consumer demand and economic stability, it can provide a solid foundation for a new venture. However, economic downturns, shifts in consumer preferences, or high competition can make it difficult for a business to succeed, even if the entrepreneur has a strong plan in place.

Investing in Stocks: Similarly, market cycles have a major impact on stock prices, and economic downturns can reduce the value of investments, lower returns, or lead to losses. Stock prices are often affected by broader economic conditions such as inflation, interest rates, and corporate earnings. While investors can benefit from economic booms and growing markets, economic recessions or market volatility can negatively influence the performance of stocks.

Key Consideration: If the economy is booming and there is strong demand for your business idea, it could be an ideal time to start a business. On the other hand, if markets are stable and showing steady growth, investing in stocks may offer a safer, more predictable opportunity with the potential for growth. The decision depends largely on your perception of the market’s current and future conditions. However, both starting a business and investing in stocks will be affected by the economy and market conditions, and it is near impossible timing the market.

8. Tax Cons

Starting a Business: Business owners can benefit from a variety of tax deductions that can help reduce their taxable income. These include deductions for business expenses like operational costs, office supplies, salaries, marketing, and even depreciation of assets. By deducting these expenses, business owners can lower their overall tax burden, making it more cost-effective to run and grow a business. However, the specific deductions available may vary depending on the country and local tax laws.

Investing in Stocks: When it comes to investing in stocks, capital gains tax applies to profits made from selling investments. However, there are tax-efficient strategies that can help reduce liabilities, such as holding investments for the long term to qualify for lower long-term capital gains tax rates or using tax-advantaged retirement accounts like IRAs or 401(k)s. These strategies can minimize the amount of taxes owed on investment profits, allowing investors to keep more of their earnings.

Illustration 7: One of the most important factors that is very often forgotten. There can be a lot of money to be saved in deductions.

Key Consideration: Depending on the tax laws in your country, one option may be more tax-efficient than the other. For instance, owning a business may offer more immediate tax benefits through deductions, while investing in stocks might provide more favorable tax treatment on long-term gains or through retirement accounts. The right choice will depend on your specific financial situation and the tax regulations in your area.

9. Emotional and Psychological Factors

Starting a Business: Starting a business involves significant emotional and psychological challenges. Entrepreneurs often face high levels of stress due to the uncertainty of the venture’s success, tight deadlines, and the need to make tough decisions on a daily basis. There are frequent emotional ups and downs, from the excitement of achieving milestones to the pressure of overcoming setbacks. Running a business requires a strong sense of persistence, resilience, and the ability to manage stress while navigating unpredictable challenges.

Illustration 8: The emotional and psychological effect is also a factor to take into account.

Investing in Stocks: Investing in stocks can also be stressful, particularly during market downturns or when investments don’t perform as expected. However, it is generally less emotionally taxing than running a business because investors have less daily involvement in managing the companies they invest in. While market volatility can lead to anxiety, stock investors typically have a more analytical, long-term focus and may be able to detach emotionally from short-term fluctuations.

Key Consideration: If you thrive under pressure and can manage uncertainty effectively, entrepreneurship might be the right path for you. It requires a hands-on approach and the ability to stay focused despite challenges. On the other hand, if you prefer a more analytical and systematic approach to decision-making, stock investing may be a better fit, offering the opportunity to reduce emotional strain while still achieving financial growth.

10. Exit Strategy

Starting a Business: Exiting a business can be a complex and time-consuming process. The most common exit strategies include selling the business, merging with another company, or liquidating the assets. Each option requires careful planning and consideration, as it often involves negotiations, legal procedures, and tax implications. The process can take months or even years, depending on the business size and market conditions, and may not always result in a favorable return.

Investing in Stocks: Stocks, on the other hand, are liquid assets that can be sold at any time, providing more flexibility and ease of access to your money. Unlike a business, which requires a detailed exit strategy, stocks can be quickly converted into cash based on market conditions. This liquidity makes investing in stocks a more accessible option for those who may need to access their funds more readily or prefer to have more control over when and how they liquidate their investments.

Key Consideration: If you value flexibility and easier access to your money, investing in stocks is likely the better option. The liquidity of stocks allows for quicker exits and fewer complications, whereas exiting a business often involves a more involved and uncertain process.

Conclusion: Which One Is Right for You?

Choosing between starting a business and investing in stocks depends on your personal preferences, financial situation, and risk tolerance.

- Go for starting a business if:

- You have a high-risk tolerance.

- You have capital and funding options.

- You are passionate about building something from scratch.

- You can handle stress and uncertainty.

- You want full control over your financial future

- Go for investing in stocks if:

- You prefer a passive income strategy.

- You have limited capital.

- You enjoy analyzing financial markets.

- You want a liquid and flexible investment.

- You prefer less direct involvement in management.