Introduction

India is more than just a country, it is a civilization that spans thousands of years, a vibrant continent in its own right, and an economic marvel constantly in motion. With a history that stretches back over five millennia, India remains one of the world’s oldest cultures while simultaneously being one of the youngest and fastest-growing economies on the planet.

Today, it stands as the most populous nation on Earth, the fifth-largest economy by nominal GDP, and a powerhouse of innovation and entrepreneurship. The economy of India is a developing mixed economy with a notable public sector in strategic sectors.

Known as the world’s largest democracy, India is a federal republic composed of 28 states and 8 union territories. It is a nuclear-armed nation, a member of influential groups such as the G20, BRICS, and the World Trade Organization, and holds a pivotal position in the Indo-Pacific region both strategically and economically.

As of 2024, India’s nominal GDP reached nearly $3.9 trillion, edging past the United Kingdom and approaching the size of Germany’s economy. When measured in purchasing power parity terms, India ranks third globally behind China and the United States. This remarkable economic ascent is fueled by a young and expanding population of 1.44 billion people, a rapidly growing middle class, and a labor force increasingly skilled in technology and services.

his article explores the complex and fascinating story of India’s economic evolution, from its early days of immense wealth through the hardships of colonialism, the challenges of socialist policies, and finally the remarkable liberalization that catapulted the nation into the global spotlight. Whether you are an investor, student, or simply curious about global affairs, India’s economic journey offers profound lessons in resilience, ambition, and transformation.

Historical Background

India’s history as an economic power dates back thousands of years, when it accounted for roughly a quarter to a third of the world’s GDP. During ancient times, great empires such as the Mauryas, Guptas, Cholas, and later the Mughals presided over prosperous kingdoms that exported textiles, spices, gems, and rich cultural knowledge to distant lands. India’s early economy was sophisticated and globally connected, making it one of the wealthiest regions on Earth.

India’s history as an economic power dates back thousands of years, when it accounted for roughly a quarter to a third of the world’s GDP. During ancient times, great empires such as the Mauryas, Guptas, Cholas, and later the Mughals presided over prosperous kingdoms that exported textiles, spices, gems, and rich cultural knowledge to distant lands. India’s early economy was sophisticated and globally connected, making it one of the wealthiest regions on Earth.

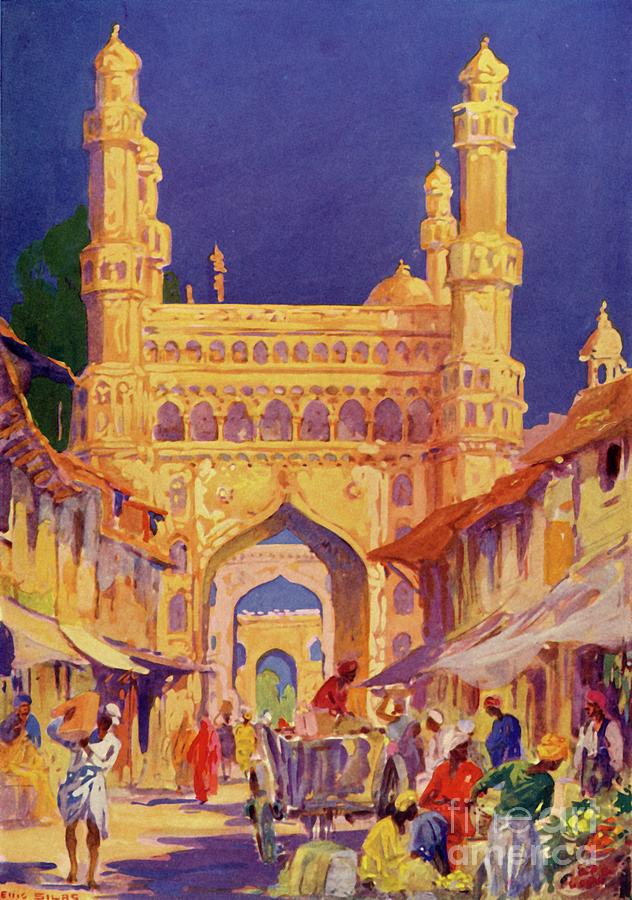

Illustration 2: Mughal Empire of India

However, the arrival of European colonial powers, especially the British East India Company in the 18th century, marked a profound shift. What was once a manufacturing and trading powerhouse became a supplier of raw materials and a captive market for British goods.

The colonial period saw the systematic deindustrialization of India’s traditional industries, such as the famous textile mills of Bengal, and the extraction of wealth that hindered economic progress for nearly two centuries. By the time India gained independence in 1947, its share of the global economy had dwindled to a mere 3%, a shadow of its former glory.

.JPG)

Illustration 3: British India led to India falling from making up 22.6% of the world economy in 1700 to 3.8% in 1952.

After independence, India embarked on a path shaped by the vision of Prime Minister Jawaharlal Nehru, who championed a socialist-inspired model of economic development. The state took control of key industries such as heavy manufacturing, banking, railways, and energy.

While this helped establish a basic industrial base, it also resulted in the notorious “License Raj,” a cumbersome system of permits and bureaucratic controls that stifled entrepreneurship and economic dynamism. For decades, India’s growth rate lingered at a modest 3 to 4 percent, a pace so slow it was mockingly dubbed the “Hindu rate of growth.

The turning point came in 1991 when a severe balance of payments crisis forced India to fundamentally rethink its economic model. Led by Finance Minister Manmohan Singh, the government embarked on sweeping reforms that dismantled import restrictions, reduced subsidies, and opened the economy to foreign investment. This liberalization unleashed a wave of economic activity that transformed India into a global player. The IT sector boomed, telecom networks expanded, pharmaceutical companies grew to global prominence, and financial markets developed rapidly. India’s economy accelerated, foreign reserves surged, and the nation gained credibility on the world stage.

The Structure of the Indian Economy

India’s economy is broadly divided into three main sectors: agriculture, industry, and services. Together, these sectors weave a complex and sometimes contradictory tapestry. While agriculture still employs the largest share of the workforce, roughly 43% of the population, it accounts for only about 20% of GDP.

Illustration 4: The Indian economy is complex like a tapestry

Industry contributes around a quarter of the GDP and employs about a quarter of the labor force. The services sector dominates the economy, representing more than half of the country’s GDP, yet employs only about a third of the workers. This structural imbalance highlights some of India’s greatest development challenges but also points to immense opportunities for growth and modernization.’

1. Industry and Manufacturing

Historically a late bloomer in manufacturing, India has increasingly turned its attention to industrial development. The government’s flagship initiative, “Make in India,” aims to expand the manufacturing sector’s share of GDP to 25 percent.

he automobile sector is one of the largest in the world, with companies like Tata Motors, Mahindra & Mahindra, bajaj auto, TVS motor company, Atul Auto and Maruti Suzuki producing millions of vehicles annually. As of 2023, India ranked as the fourth-largest automobile producer in the world, following China, United States and Japan. T

he sector accounts for approximately 7.1% of India’s GDP and employs over 37 million people directly and indirectly. As of April 2022, India’s auto industry is worth more than US$100 billion and accounts for 8% of the country’s total exports and 7.1% of India’s GDP.

Illustration 5: India is one of the world’s largest producers of tuk tuks

The pharmaceutical industry, often called the “pharmacy of the world,” manufactures 60 percent of the world’s vaccines and is a global leader in generic drugs. Heavy industries such as steel, cement, and chemicals are dominated by conglomerates like Tata Steel and Aditya Birla Group.

India is also carving a niche in emerging industries such as semiconductors, solar energy equipment, and electric vehicles, with states like Gujarat and Tamil Nadu competing fiercely to attract large factories and investment. Defense manufacturing is another growing priority, as India seeks to reduce its dependence on arms imports and develop indigenous capabilities.

Mining contributed to 1.75% of GDP and employed directly or indirectly 11 million people in 2021. India’s mining industry was the fourth-largest producer of minerals in the world by volume, and eighth-largest producer by value in 2009.

In output-value basis, India was one of the five largest producers of mica, chromite, coal, lignite, iron ore, bauxite, barite, zinc and manganese; while being one of the ten largest global producers of many other minerals.

Illustration 6: Rajesthan is one of the indian states with the most natural resources

Indian cement industry is the 2nd largest cement producing country in the world, next only to China. At present, the Installed Capacity of Cement in India is 500 MTPA with production of 298 million tonnes per annum. Majority of the cement plants installed capacity (about 35%) is located in the states of south India.

India surpassed Japan as the second largest steel producer in January 2019.The country’s steel sector benefits from abundant iron ore reserves, a large labor force, and strong government support through initiatives like “Make in India” and the National Steel Policy. As demand for steel rises both domestically and globally, India continues to expand its production capacity and export footprint.

Petroleum products and chemicals are a major contributor to India’s industrial GDP, and together they contribute over 34% of its export earnings. India hosts many oil refinery and petrochemical operations developed with help of Soviet technology such as Barauni Refinery and Gujarat Refinery, it also includes the world’s largest refinery complex in Jamnagar that processes 1.24 million barrels of crude per day.

By volume, the Indian chemical industry was the third-largest producer in Asia, and contributed 5% of the country’s GDP. India is one of the five-largest producers of agrochemicals, polymers and plastics, dyes and various organic and inorganic chemicals. Despite being a large producer and exporter, India is a net importer of chemicals due to domestic demands. India’s chemical industry is extremely diversified and estimated at $178 billion.

India is one of the largest producers and consumers of chemicals and fertilizers in the world, with the chemical industry contributing over 7% to the country’s GDP and ranking 6th globally in chemical production. At present, 57 large fertilizer units are manufacturing a wide number of nitrogen fertilizers. These include 29 urea-producing units and 9 ammonia sulfate-producing units as a by-product. Besides, there are 64 small-scale producing units of single super phosphate.

The fertilizer sector, vital for India’s agriculture, produced around 43.7 million tonnes of fertilizers in 2024–25, including urea, DAP, and complex fertilizers, supported by government subsidies and increasing adoption of nutrient-based fertilizers. The growing demand from agriculture, textiles, and pharmaceuticals continues to drive expansion in both sectors.

Illustration 7: India is one of the largest producers of dye in the world.

Furthermore, when it comes to transportation India is the third-largest domestic aviation market in the world, with passenger traffic reaching over 280 million in 2023. As of 2024, the country has 149 operational airports, up from 74 in 2014, and the government plans to expand this to 220 airports by 2030 under a 1 trillion Indian rupees infrastructure push.

India’s railways, contributing about 2% to the country’s GDP, transport over 8 billion passengers and 1.2 billion tonnes of freight annually, making it one of the world’s largest and busiest rail networks. The sector supports around 7 million jobs, both directly and indirectly, playing a crucial role in driving economic growth and connecting markets across the nation. With ongoing investments in modernization, electrification, and high-speed rail, Indian Railways is set to boost productivity and sustainability even further.

Illustration 8: Mumbai train station

India also has multiple ship building companies such as Cochin Shipyard, Hindustan Shipyard and Swan Defence and Heavy Industries, mainly produces ships for European, South American and African shipping companies. Cochin shipyard is the pioneer in autonomous electric propulsion ships.

2. Agriculture – The Paradox of Inida’s economy

Agriculture remains the cornerstone of India’s socio-economic landscape, deeply intertwined with the lives of over 40% of the population who depend on it for their livelihoods. Despite its declining share of around 16-17% in the country’s GDP, the sector is critical for ensuring food security, sustaining rural communities, and maintaining social stability across vast regions.

India proudly holds the title as the world’s largest producer of milk, pulses, and spices, and is among the top global producers of staples like rice, wheat, sugarcane, cotton, and a wide variety of fruits and vegetables, feeding over 1.4 billion people.

Yet, beneath this agricultural abundance lies a paradox: low productivity and fragmented landholdings often limit farmers’ incomes and economic resilience. Most farms are small, averaging less than 2 hectares, which constrains the adoption of advanced technology and efficient farming practices.

Additionally, frequent climate shocks, such as droughts, floods, and erratic monsoons, leave millions vulnerable and threaten crop yields year after year. Infrastructure challenges, including inadequate irrigation, poor storage facilities, and inefficient supply chains, further reduce farmers’ ability to maximize profits and reach larger markets.

Illustration 9: India is one of the largest producers of tea

Recognizing these challenges, India has embarked on a path to modernize agriculture by investing in better irrigation systems, promoting mechanization, improving rural roads and cold storage, and embracing digital technologies like satellite imaging and mobile apps to provide real-time information to farmers.

India’s agriculture and allied sectors remain a vital part of the economy, accounting for 18.4% of GDP and employing nearly 46% of the workforce, despite the sector’s shrinking share in overall economic output, from 52% in 1951 to around 15% in 2023.

The country boasts the largest arable land area in the world, ranking as a top global producer of milk, pulses, spices, rice, wheat, sugarcane, cotton, fruits, and vegetables. However, productivity challenges persist, with yields often only 30% to 50% of global best practices due to small landholdings, inadequate irrigation (only about 39% of cultivated land is irrigated), and infrastructure gaps in storage, roads, and markets. These issues limit farmers’ incomes and keep agricultural output below its full potential.

India is also a global leader in fisheries and aquaculture, ranking 3rd and 2nd respectively, providing livelihoods to millions, and exporting significant quantities of processed products like cashew kernels and milk. While the country produces roughly 316 million tonnes of foodgrains annually, stagnation in output and large post-harvest losses, up to one-third of production, highlight inefficiencies.

Government initiatives like the ₹1.2 trillion Accelerated Irrigation Benefit Programme aim to improve irrigation and infrastructure, but regulatory hurdles and market constraints continue to slow progress. Overall, India’s agriculture sector is a complex blend of immense scale, rich diversity, and urgent need for modernization to boost productivity and farmer prosperity.

Illustration 10: Indian women pounding rice, India is one of the world’s largest rice producers

However, progress has been uneven and often slowed by political sensitivities and social complexities. The massive farmer protests of 2020–21 underscored the deep-rooted concerns and emotional ties surrounding land rights, pricing, and market reforms. These protests highlighted how any attempt to transform India’s agricultural sector must carefully balance economic modernization with the protection of farmers’ livelihoods and rights.

Looking ahead, the future of Indian agriculture depends on successfully navigating this delicate balance, integrating technology and innovation while ensuring inclusivity and sustainability. With targeted reforms, climate-resilient farming practices, and strengthened rural infrastructure, India has the potential not only to feed its vast population but also to emerge as a global leader in sustainable agriculture.

3. Services – The Crown Jewel

The services sector has emerged as the undisputed engine of India’s economic growth, contributing a staggering over 50% of the country’s GDP, making it the largest sector in the Indian economy. From IT and software exports to financial services, healthcare, education, telecommunications, tourism, logistics, and more. the breadth and dynamism of this sector reflect India’s transition from a primarily agrarian economy to a global services leader.

Illustration 11: The city of Hyderabad is becoming a global hub for IT.

Cities like Bengaluru, Hyderabad, Gurugram, and Pune have become world-renowned hubs for IT, software development, business process outsourcing (BPO), and innovation, attracting investments from global tech giants and startups alike.

India’s Information Technology and Business Process Management (IT-BPM) sector alone generated over $250 billion in revenue in 2023, employing more than 5 million professionals, and contributing significantly to foreign exchange earnings.

Indian IT firms serve clients across the globe, from Silicon Valley startups to Fortune 500 corporations, delivering everything from cloud computing to AI solutions. Beyond tech, India’s financial services sector, anchored by robust public and private banks, insurance companies, fintech startups, and stock exchanges like NSE and BSE, plays a pivotal role in capital formation and investor confidence.

India’s telecom sector is a global giant, now the second-largest market in the world with over 1 billion phone subscribers and one of the lowest call tariffs due to intense competition. In FY 2024, telecom equipment production crossed ₹45,000 crore, with exports hitting ₹10,500 crore, driven by the booming smartphone manufacturing industry. India also ranks among the top three globally in internet users, and is the largest DTH television market by subscribers making digital connectivity a key pillar of its economic growth.

Equally significant is the rise of tourism, healthcare, education, retail, e-commerce, and digital services, all of which are rapidly expanding with the growing urban middle class and increasing internet penetration. The Unified Payments Interface (UPI) revolutionized digital transactions, processing billions of transactions monthly, and helped formalize vast segments of the economy. Meanwhile, the services sector has also become a major employment generator, especially in urban and semi-urban areas, offering opportunities in both high-skilled and low-skilled segments.

The government’s focus on initiatives like Digital India, Skill India, and Start-Up India further accelerates the services sector’s potential, promoting entrepreneurship, digital infrastructure, and employment. However, to sustain this momentum, India must address key challenges, such as improving ease of doing business, upskilling the workforce, enhancing service exports, and bridging the digital divide in rural areas.

In essence, the services sector is not just a component of India’s economy, it is its beating heart, transforming the country into a knowledge-based, innovation-driven powerhouse that is well on its way to becoming a major player in the global economic landscape.

Innovation and the Digital Revolution

India’s 63 million MSMEs (Micro, Small, and Medium Enterprises) contribute 35% to GDP, employ over 111 million people, and make up 40% of exports, earning their title as the “growth engines” of the economy. Though 90% are micro-enterprises with limited scale, 2023 saw a record 179 SME IPOs, showing rising investor interest. With continued policy support and reforms, MSMEs hold the key to tackling unemployment and driving inclusive growth.

India’s digital transformation has been nothing short of revolutionary. Central to this has been the Unified Payments Interface (UPI), a real-time digital payment system that processes billions of transactions monthly, outpacing even the combined digital payments of the US, China, and the EU. The Aadhaar biometric identification system has provided over 1.3 billion Indians with a unique digital identity, enabling unprecedented access to banking, government services, and welfare programs.

Together with the Jan Dhan-Aadhaar-Mobile (JAM) trinity, these innovations have democratized access to finance and services across vast rural and urban populations. The government’s Digital India initiative aims to further embed technology into governance, business, and daily life, while targeted programs such as Startup India and the Semiconductor Mission are propelling innovation and domestic manufacturing.

Furthermore, India’s youthful population is one of its greatest assets. With a median age of just 28.4 years, India is far younger than many developed countries whose median ages often exceed 40. Each year, approximately twelve million young people enter the labor market, creating both an opportunity and a challenge to generate sufficient employment. By 2030, India is expected to be home to seven megacities and more than 600 million urban residents, fueling demand for housing, infrastructure, transportation, and services.

Illustration 12: India’s population is very young something that can become its great asset.

The key to harnessing this demographic dividend lies in education and skills training to ensure that young Indians are productive contributors to the economy rather than unemployed or underemployed.

India’s cultural richness and heritage form a vital pillar of its economy. The country attracted more than 17 million tourists in 2023, contributing significantly to local economies.

Beyond the traditional pilgrimage and heritage tourism sectors, India’s global influence is bolstered by Bollywood, yoga, cuisine, cricket, and festivals that resonate worldwide. The Indian diaspora, numbering over 30 million people globally, acts as a powerful cultural and economic bridge, enhancing India’s soft power and international reputation.

Illustration 13: A Bollywood poster

Trade and Global Integration

India’s role in global trade continues to expand rapidly. As the world’s ninth-largest exporter of goods and sixth-largest importer, India’s export basket includes refined petroleum, gems and jewelry, pharmaceuticals, automobiles and parts, and software services. The United States, China, the United Arab Emirates, the European Union, and ASEAN nations are India’s most significant trading partners.

India is actively negotiating free trade agreements with major economies like the UK and the EU and is building regional supply chains to reduce reliance on China and enhance economic resilience. On the global stage, India positions itself as a leading voice for the developing world, championing issues such as debt relief, food security, and climate action, especially during its G20 presidency in 2

Credit Score

India currently holds a sovereign credit rating of “BBB-” with a stable outlook from S&P and Fitch, and a “Baa3” from Moody’s, both of which are the lowest investment-grade ratings. These ratings indicate that India is a relatively safe destination for investment, but with moderate credit risk. The scores reflect a balance between India’s strong long-term growth prospects and structural economic challenges such as a high fiscal deficit, significant public debt, and dependency on imported energy.

The rating agencies acknowledge India’s resilient and diversified economy, large domestic market, improving infrastructure, and digital innovation as strengths. India’s track record of stable democratic governance, reforms in taxation (like GST), and emphasis on infrastructure and ease of doing business further support its rating. However, concerns remain over fiscal discipline, with the government debt-to-GDP ratio hovering around 83%, and recurring fiscal deficits above 5%, driven by subsidies, welfare schemes, and lower tax revenues.

Despite global economic uncertainties, India’s strong GDP growth, estimated at around 6–7% annually, even during volatile periods, continues to reinforce investor confidence. Many experts believe that with continued reforms, improved tax collection, and responsible fiscal management, India could see a credit upgrade in the coming years, which would lower borrowing costs and attract more foreign investment.

Challenges and contradictions

Despite its impressive rise, India faces deep-seated challenges. Income inequality is stark, with the richest one percent controlling more than 40% of the nation’s wealth. Structural issues such as unemployment. especially among youth and graduates, remain unresolved. While India has made strides in reducing corruption and improving ease of doing business, bureaucratic inertia and red tape still hinder many entrepreneurs.

Environmental problems loom large as well. Air pollution in cities frequently reaches hazardous levels, water scarcity threatens agriculture and urban centers, and climate change presents an existential risk to development gains. Public debt, while moderate compared to many developed nations, is rising and will require careful fiscal management.

.jpg)

Illustration 14: Ambani tower in India highlighting the difference between rich and poor in the country.

India’s Global Ambitions

Looking forward, India has set ambitious goals to become a $5 trillion economy by 2027 and to join the ranks of the world’s top three economic powers by 2050. The government’s vision of “Viksit Bharat,” or Developed India, aims for transformational progress by the centenary of independence in 2047.

Priority sectors include renewable energy, where India is already a global leader in solar power and has pledged to reach net-zero carbon emissions by 2070. Defense manufacturing, advanced technologies such as artificial intelligence and quantum computing, biotechnology, and infrastructure development are all central to India’s future growth plans.

Massive investments in freight corridors, expressways, and ports are underway to improve logistics and connect the vast country more efficiently.

Conclusion

India’s economy embodies a unique paradox. It is ancient and modern, fast-growing yet uneven, chaotic yet bursting with creative energy. Unlike the more streamlined and centralized economies of Germany or China, India’s democratic capitalism is messy and vibrant, shaped by millions of individual decisions, countless startups, and an energetic population.

Illustration 15: India is one of the fastest growing economies in the world.

Its rise is not just an economic story but a human one, about a nation harnessing its vast potential, striving to lift hundreds of millions out of poverty, and aiming to reshape the global economic order. As smartphones proliferate in small towns, solar panels spread across deserts, and coding campuses thrive in Bangalore and Hyderabad, India is writing a new chapter in the story of global growth.

India’s economy is a dynamic blend of traditional strength and modern innovation, driven by a powerful services sector, a vast and evolving agricultural base, and a rapidly growing industrial and manufacturing ecosystem. With a young population, expanding digital infrastructure, and consistent GDP growth averaging 6–7%, India is well-positioned to become one of the world’s leading economic powers. However, to fully unlock its potential, the country must address key challenges like unemployment, low agricultural productivity, infrastructure gaps, and fiscal discipline, while continuing to invest in reforms, technology, and human capital.

:max_bytes(150000):strip_icc()/closeup-of-big-gold-nugget-511603038-5ad92a97fa6bcc00362b919b.jpg)