Figure 1: Mining production can affect the price of silver

The supply of silver is primarily driven by mining production. Silver is primarily produced as a byproduct of mining other metals like copper, lead, and zinc. As such, the supply of silver is heavily influenced by the mining industry’s production of these metals. If the production of these metals increases, the supply of silver will also increase, leading to a potential decrease in price. Conversely, if the production of these metals decreases, the supply of silver will also decrease, leading to a potential increase in price.

Another factor that can affect the supply of silver is recycling. Silver can be recovered from a variety of sources, including electronic waste, jewelry, and industrial waste. The amount of silver that is recycled can impact the overall supply of the metal. If the amount of silver that is recycled increases, the supply of silver will also increase, leading to a potential decrease in price. Conversely, if the amount of silver that is recycled decreases, the supply of silver will also decrease, leading to a potential increase in price.

Silver is an important industrial metal, with a wide range of uses in various industries. It is a key component in the production of electronics, solar panels, batteries, and medical equipment, among other things. As such, the demand for silver is largely tied to the health of the global economy. During times of economic growth, demand for silver tends to increase as industries expand and more products are produced. Conversely, during times of economic contraction, demand for silver tends to decline as industries contract and production slows down.

Silver is also a popular investment asset, with investors using it to diversify their portfolios and protect against inflation. During times of economic uncertainty, investors tend to flock to safe-haven assets like silver, which can help to protect their wealth in the event of a market downturn. This can cause the price of silver to rise as demand increases.

When it comes to the demand large traders or investors can have much to say. The silver market is much smaller than the gold market and is actually much smaller than many companies. The London gold market alone turns over 18 times more monetary value than silver. With physical demand estimated at around only $15 billion per year it may be possible for a large trader or investor to influence the silver price either positively or negatively. An example of this could be when the Hunt brothers were accused of attempting to corner the silver market in 1979. They were estimated to have accumulated over 100 million troy ounces of silver, potentially contributing to the increase in price from $6 to $48.40 as seen in the graph below. The y-axis represent the nominal price of silver while the x-axis represents the year.

A big driver for silver sales in 2012 was Morgan Stanley and their short position holdings. This has influenced the silver market, along with an apparent shortage of above ground silver available for investment. As silver continues to boom for industrial uses, less of the metal is available for physical bullion for investment. That, coupled with paper investment uncertainty, has driven the market prices wildly.

Silver is also used in the production of jewelry. The demand for silver jewelry is largely driven by fashion trends and consumer preferences. In some cultures, silver is also used as a store of value or a form of currency, which can drive up demand for the metal.

The interaction between supply and demand is what ultimately determines the price of silver. If the demand for silver is greater than the supply, the price will increase. Conversely, if the supply of silver is greater than the demand, the price will decrease. Worlds largest silver producers by country are : 1.Mexico, 2. Peru, 3. China, 4. Australia, 5. Chile, 6. Poland, 7. Russia, 8. Bolivia, 9. USA. Worlds largest silver consumers are: 1. USA, 2. China, 3. Japan, 4. India, 5. Germany, 6. Italy.

Price elasticity is another important factor to consider when it comes to silver investing. Price elasticity refers to the degree to which the demand for silver changes in response to a change in price. If the demand for silver is highly elastic, meaning that even small changes in price can cause a significant change in demand, then the price of silver will be highly volatile. Conversely, if the demand for silver is relatively inelastic, meaning that changes in price have little impact on demand, then the price of silver will be relatively stable.

Financial Stress/Hedging

Silver is considered a safe heaven during times of volatility/ insecurity in the markets. So if there is volatility or one or more of the large currencies fail the price of silver will go up. Silver can also be used as a hedge against inflation and deflation. A hedge is essentially a way to safeguard yourself when you are investing. You may feel vulnerable as you look at your portfolio, especially if experts are predicting a downturn. Hedging can be a form of insurance against the risk you feel you’re taking with the other items in your portfolio.

You’ll see hedging as a strategy used by professional brokers as they help you build your portfolio. They’ll look at safer investments to offset the high-risk items they choose. The theory is that, if things go wrong, you’ll have some items in your portfolio that may be gaining or holding their value to help reduce your losses.

Figure 3: Silver can be a hedge in uncertain times

Political factors such as government policies, regulations, and trade agreements can impact the supply and demand of silver. In addition, political instability, such as war or civil unrest, can also lead to an increase in demand for safe-haven assets like silver, causing the price to rise.

Despite the subtle dangers of silver, it’s popular with investors, especially during tough times. This puts it in the category of a safe haven, which is defined as an investment that is expected to hold its value as the market turns turbulent. However, no safe haven is guaranteed in every market, which means it’s important to research silver before putting money into it.

Due to its slightly safer natur some investors choose to make silver a part of a larger portfolio. Although you won’t earn interest on that part of your portfolio over the years, it can be useful as a hedge against inflation. The fact that they tend to do better when other stocks are failing can help balance out your portfolio.

Many still invest in silver and gold stocks, though, with the logic that metals tend to fare well during stock market crashes. While this has historically been true of gold, that same improved performance doesn’t apply to silver. Silver is used heavily in industrial sectors, which makes it more likely to be tied to the performance of the greater economy.

Technology

Silver is an important component in many electrical products. As more people use modern technology, the demand for silver slowly increases.

Unlike gold, the price of silver swings between its perceived role as a store of value and its role as an industrial metal. For this reason, price fluctuations in the silver market are more volatile than gold. So, while silver will trade roughly in line with gold as an item to be hoarded, the industrial supply/demand equation for the metal exerts an equally strong influence on its price.

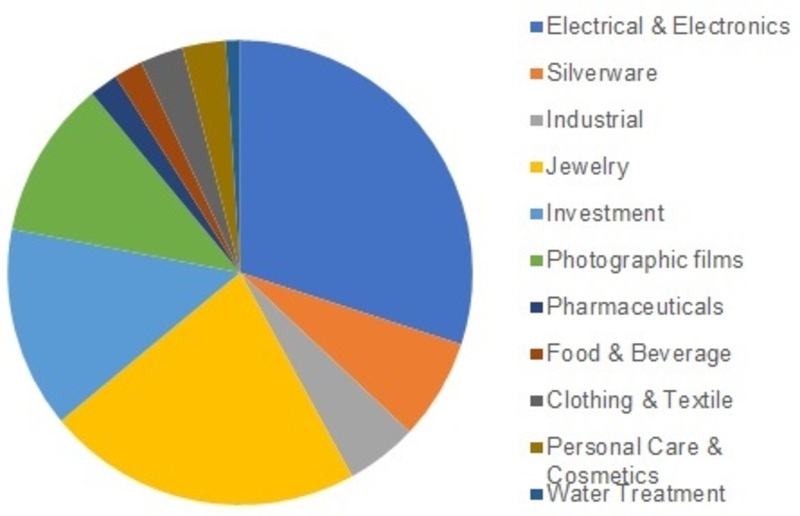

Figure 4: Market for silver

That equation has always fluctuated with new innovations, including: Silver’s once predominant role in the photography industry—silver-based photographic film—which has been eclipsed by the advent of the digital camera.

The rise of a vast middle class in the emerging market economies of the East, which created an explosive demand for electrical appliances, medical products, and other industrial items that require silver inputs. From bearings to electrical connections, silver’s properties made it a desired commodity. Silver’s used in batteries, superconductor applications, and microcircuit markets.

How to Buy Silver

There are several ways to invest in silver, including physical silver, exchange-traded funds (ETFs), futures contracts, and mining stocks. Each of these investment options has its own advantages and disadvantages, and investors should carefully consider their options before making a decision.

Investors can invest in silver through ETFs, which track the price of silver and trade like stocks. ETFs offer investors the ability to invest in silver without actually owning the physical metal, making them a convenient and cost-effective investment option.

Funds like the iShares Silver Trust (SLV) have made it quite easy for regular retail investors to enter the silver market. This industrial demand makes silver prices more volatile than gold and generally reactive to various measures of manufacturing data. Given this fact, ETFs that track silver prices or futures could be a better bet versus physical bullion, as they can be sold quite easily if investors think prices are too frothy.

Then there are costs to consider. Buying physical silver comes with added costs many investors may not be thinking of. First, investors have to pay an average of 5% to 6% in commissions to acquire silver coins and bullion, depending on the source. Then there are the storage costs to consider. Safety deposit boxes at banks carry an annual fee and home safes can range into the thousands, depending on the size, while precious metals IRAs and custodial accounts come with yearly storage fees as well.

For the cost of just one share that trades at roughly spot price and as little as 0.50% in yearly expenses, investors can access silver via an ETF. A perfect example of the potential problems with ETF stems from the bankruptcy of MF global in the late 2011. Investors who held warehouse silver bars within the firm’s accounts had their assets frozen and pooled together. The liquidating trustee in the court-approved bankruptcy paid these investors about 72 cents on the dollar for their holdings. In other words, these investors lost 28% of their bullion. With some silver participants claiming manipulation in the silver markets with regards to many of the big ETF/ETN sponsors, owning physical bullion could pay-off in the real end.

Finally, ETF fees do have an eroding effect on their underlying prices. Many of the physically-backed funds sell a portion of their bullion to pay for their expenses. Over time, this has caused share prices to track less than spot. Shareholders don’t actually own title to the metal itself unless they are an authorized participent in an ETF. On the other hand, when you own actual silver it’s yours. If the world goes “crazy,” you have the store of value directly in your own hands or vault. This fact underscores the number one reason why most investors choose precious metals in the first place: insurance.

The third way to invest in silver is by buying silver mining stocks. Publicly-traded silver mining companies are located across the globe and can help you make a profit. As silver prices rise and fall, you’ll see your stocks in mining companies follow those trends. However, events such as an accident may affect a mining company even when silver is performing well.

Another option is to invest in something called a silver streaming company. A streaming company doesn’t directly deal in mining steel but instead offers financing to them in exchange for shares. These streaming companies are also affected by fluctuations in silver prices, but their ability to keep a steady stream of financing deals can also affect their stocks.

Investors can also invest in silver through futures contracts, which allow them to purchase silver

Warren Buffet (did not make much money on it/don’t advise it), “didn’t get where we are by owning silver”- Charlie Monger.

Leave a Reply