Introduction

Brazil is the largest country in South America and the fifth largest in the entire world. Th Brazilian economy is as big, rich and diverse as the country itself. With a rich history shaped by colonization, slavery, and resource extraction, Brazil has evolved into a modern economy marked by both potential and challenges.

Figure 1: Brazilian Flag

As one of the BRICS nations, alongside Russia, India, China, and South Africa, Brazil is often highlighted as a key player among emerging markets. However, its economic journey has been far from linear, characterized by periods of rapid growth, deep recessions, and ongoing structural challenges. his video will look deeper into the various facets of Brazil’s economy, exploring its history, structure, key industries, challenges, and future prospects.

The Economy of Brazil is currently the largest in Latin America and the 8th largest in the world with a nominal GDP of US$2.331 trillion and a GDP per capita of US$11,178 per inhabitant. In 2024, according to Forbes, Brazil was also the 7th largest country in the world by number of billionaires, and is one of the ten chief industrial states in the world.

The country is rich in natural resources. From 2000 to 2012, Brazil was one of the fastest-growing major economies in the world, with an average annual GDP growth rate of over 5%. Its GDP surpassed that of the United Kingdom in 2012, temporarily making Brazil the world’s sixth-largest economy. However, Brazil’s economic growth decelerated in 2013 and the country entered into a recession in 2014. The economy started to recover in 2017, with a 1% growth in the first quarter, followed by a 0.3% growth in second quarter compared to the same period of the previous year. It officially exited the recession.

Historical Context

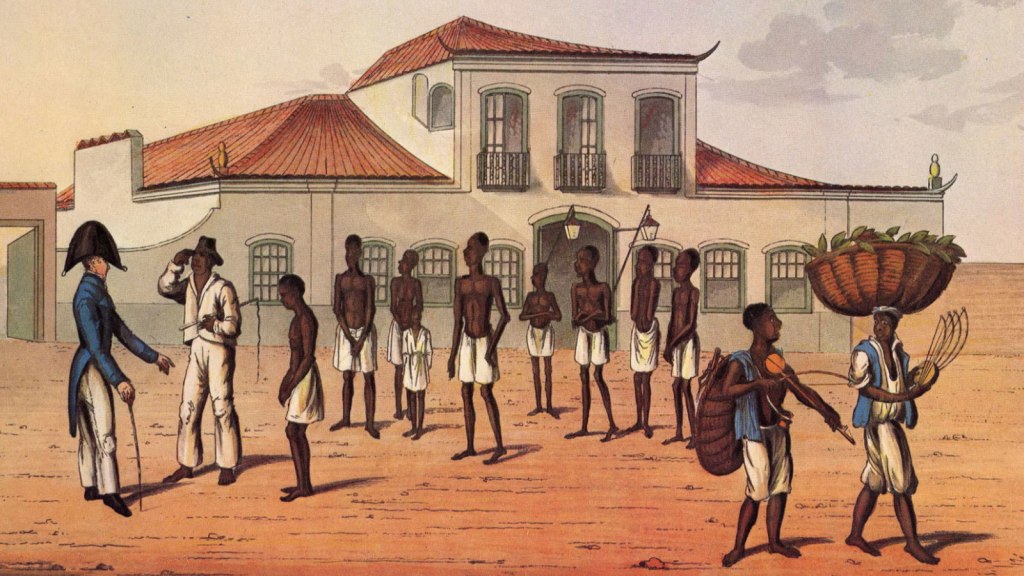

Brazil’s economic foundations were laid during the colonial period under Portuguese rule, beginning in the early 16th century. The economy was initially based on the extraction of natural resources and agriculture, particularly sugarcane, which became the dominant export product in the 16th and 17th centuries. The use of African slave labor was integral to the Brazilian economy during this period, a legacy that has had long-lasting social and economic impacts to this day.

Figure 2: Slaves arrive in Brazil

In the 18th century, gold and diamond mining became the primary economic activities, particularly in the state of Minas Gerais. However, by the early 19th century, these resources began to dwindle, leading to economic decline. The country’s economy during this time was heavily dependent on exports, making it vulnerable to fluctuations in global demand and prices.

Following its independence from Portugal in 1822, Brazil’s economy gradually shifted towards coffee production, which became the dominant export by the mid-19th century. The coffee boom brought significant wealth to the country, especially to the Southeast region, but also exacerbated regional inequalities.

During the 19th century Brazil experienced a period of strong economic and demographic growth accompanied by mass immigration from Europe. This migration had positive effects on the country’s human capital development The immigrants usually exhibited better formal and informal training than native Brazilians and tended to have more entrepreneurial spirit. Their arrival was beneficial for the region, not only because of the skills and knowledge they brought to the country themselves, but also because of spillover effects of their human capital to the native Brazilian population. Human capital spillover effects were strongest in regions with the highest numbers of immigrants, and the positive effects are still observable today, in some regions.

Figure 3: In Rio, the diversity of backgrounds are still noticeable

The early 20th century marked the beginning of Brazil’s industrialization, largely driven by the coffee elites who invested in manufacturing. The country’s involvement in World War I further accelerated industrialization, as global supply chains were disrupted, leading to the development of local industries.

During the 1930s Brazil implemented protectionist policies, promoted industrialization, and established state-owned enterprises in key sectors such as steel, oil, and electricity. This period also saw the rise of labor rights and social welfare programs. Post-World War II, Brazil continued to pursue industrialization under the Import Substitution Industrialization (ISI) strategy, which aimed to reduce dependency on imported goods by fostering domestic industries. The 1950s and 1960s were characterized by rapid industrial growth, urbanization, and the expansion of the middle class. However, this period also saw rising inflation, income inequality, and external debt.

The Debt Crisis and Economic Reforms

By the 1980s, Brazil was facing a severe debt crisis. The ISI model had led to inefficiencies, high inflation, and an over-reliance on foreign debt. The country was forced to implement austerity measures and seek assistance from the International Monetary Fund. The 1980s, often referred to as the “Lost Decade,” were marked by economic stagnation, hyperinflation, and social unrest.

In the 1990s, Brazil embarked on a series of neoliberal economic reforms. Brazil also implemented trade liberalization, privatization of state-owned enterprises, and deregulation. These reforms laid the groundwork for the economic growth that Brazil experienced in the early 21st century.

Structure of the Brazilian Economy

Brazil’s economy is characterized by a diverse mix of industries, including agriculture, manufacturing, mining, and services. Even though, itis one of the largest economies in the world by nominal GDP and is classified as an upper-middle-income mixed economy by the World Bank, Brazil also faces significant challenges, including income inequality, political instability, and structural inefficiencies.

Agriculture

Agriculture has historically been a cornerstone of Brazil’s economy and continues to play a vital role. Brazil is one of the world’s leading producers and exporters of several agricultural products, including soybeans, coffee, sugar, beef, and poultry. The country’s vast and fertile land, coupled with favorable climate conditions, has made it a global agricultural powerhouse and led to the expression, “Brazil, breadbasket of the world”.

As of 2024 the country is the second biggest grain exporter in the world, with an astounding 19% of the international market share, and the fourth overall grain producer. Brazil is the world’s largest exporter of countless popular agriculture commodities like coffee, soybeans, organic honey, maize, beef, poultry, cane sugar, açai berry, orange juice, yerba mate, cellulose, tobacco, and the second biggest exporter of pork, cotton, and ethanol. The country also has a significant presence as producer and exporter of rice, wheat, eggs, refinedsugar, cocoa, beans, nuts, cassava, sisal fiber, and diverse fruits and vegetables.

Figure 4: Agriculture in Brazil is an important and large industry

In 2019, the country was the world’s largest exporter of chicken meat. It was also the second largest producer of beef, the world’s third largest producer of milk, the world’s fourth largest producer of pork and the seventh largest producer of eggs in the world. In Food industry, Brazil s also the 2nd largest exporter of processed foods in the world, with a value of $34.1 billion USD in exports. In the space of fifty five years (1950 to 2005), the population of Brazil grew from 51 million to approximately 187 million inhabitants, an increase of over 2 percent per year. The local consumption of Brazil has thus also increased.

Farm-based crop storage (e.g., using silos) is not common in Brazil. Lack of storage forces produce to be commercialized quickly. According to Conab data, only 11% of warehouses are located on farms (by comparison Argentina has 40%, the European Union has 50% and Canada has 80%). Farmers rely on third party storage services. Crops are immediately trucked to market via highways, mostly in poor traffic conditions at high cost. However, the agricultural sector has benefited from significant technological advancements, particularly in areas such as genetically modified crops, precision agriculture, and improved irrigation techniques.

Figure 5: Brazilian Agriculture leading to deforestation

Critisicism against the agriculture sector is that its expansion has led to deforestation, particularly in the Amazon rainforest, raising concerns about environmental sustainability. The sector is also highly vulnerable to climate change, which poses risks to crop yields and livestock production.

Industry

Brazil’s industrial sector is diverse, encompassing a wide range of industries, including automobiles, aerospace, steel, chemicals, electronics, and textiles. The country has a well-developed manufacturing base, particularly in the Southeast region, which is home to major industrial hubs such as São Paulo, Rio de Janeiro, and Belo Horizonte.

The automotive industry is one of the largest and most important sectors in Brazil, with the country being a major producer and exporter of vehicles. Companies like Volkswagen, Fiat, and General Motors have significant manufacturing operations in Brazil. The country is the 8th producer of vehicles and the 9th producer of steel in the world. The aerospace industry, led by Embraer the third largest aircraft manufacturer in the world behind Boeing and Airbus, is another key sector, with Brazil being one of the largest producers of commercial aircraft. The country is also the 2nd largest producer of pulp in the world and the 8th producer of paper. In the footwear industry Brazil ranks 4th among world producers, and 5th when it comes to textiles.

Figure 6: Embraer planes by the hangar. Embraer is a brazilian company.

in the last years, the defence industry in Brazil achieved prominence with exports of more than US$1 billion per year and sales abroad of high-technology products like the transport jet PARTICULARY Embraer jetc. Embraer is one the world’s top 100 defense contractors.

In 2019, Brazil’s industrial sector represented 11% of Brazil’s economic activity. The Brazilian industry is one of those that showed the most decline in the world in almost 50 years. The deindustrialization of the Brazilian economy is very particular and happened very early. It is normal for the industry to lose space when the per capita income of families starts to grow, since they consume more services and less goods, however, in Brazil, a high per capita income was not reached and the country did not get rich enough for the productive structure to migrate so quickly. The stagnation of the sector partly explains the slow resumption of the labor market in the country. Despite its strengths, Brazil’s industrial sector faces several challenges. High taxes, complex regulations, and inadequate infrastructure have hindered competitiveness. Additionally, the sector has struggled with low productivity and has been slow to adopt new technologies, such as automation and digitalization.

Mining and Energy

Brazil is a country rich in natural resources, particularly minerals and energy resources. The mining sector is a major contributor to Brazil’s GDP and exports, with companies like Vale being global leaders in the industry.

Figure 7: The Brazilian company Vale is one of the largest mining companies in the world.

In the mining sector, Brazil stands out in the extraction of iron ore (where it is the second world exporter), copper, g old, bauxite (one of the 5 largest producers in the world), manganese (one of the 5 largest producers in the world), tin (one of the largest producers in the world), niobium (concentrates 98% of reserves known to the world) and nickel. In terms of gemstones, Brazil is the world’s largest producer of amethyst, topaz, agate and one of the main producers of tourmaline, emerald, aquamarine, garnet and opal.

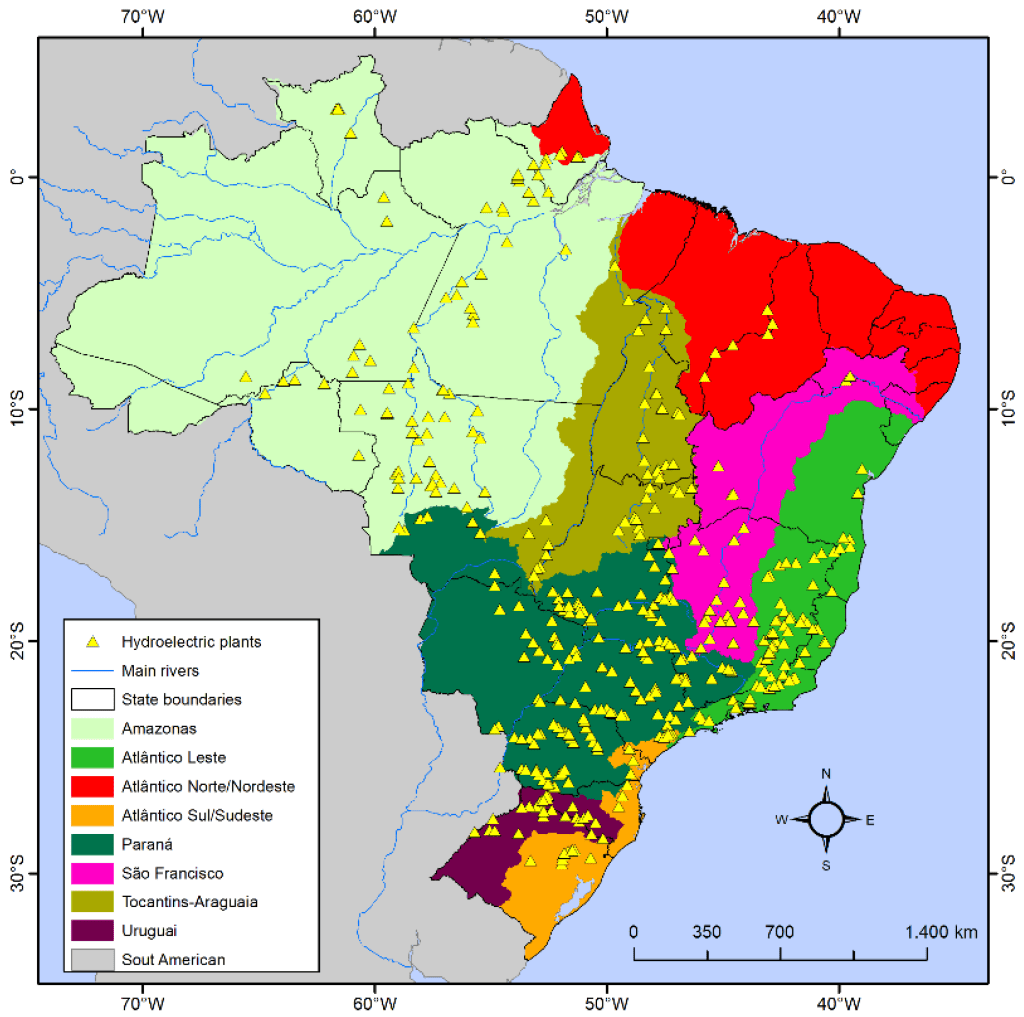

The energy sector is also crucial to Brazil’s economy, with the country being a major producer of oil, natural gas, and biofuels. Brazil is the largest producer of ethanol from sugarcane, and biofuels play a significant role in the country’s energy matrix. Additionally, Brazil has a well-developed hydropower infrastructure, with hydroelectricity accounting for the majority of the country’s electricity generation.

Figure 8: Map of hydroelectric plants in Brazil.

In 2019, Brazil had 217 hydroelectric plants in operation making up more than 60 % of the country’s energy generation. In addition, wind energy represented 9% of the energy generated in the country. It is estimated that the country has an estimated wind power generation potential of around 522 GW (this, only onshore), enough energy to meet three times the country’s current demand. In 2021 Brazil was the 7th country in the world in terms of installed wind power, and the 4th largest producer of wind energy in the world, behind only China, USA and Germany. Nuclear energy also accounts for about 4% of Brazil’s electricity. The nuclear power generation monopoly is owned by Eletrobrás Eletronuclear S/A, a wholly owned subsidiary of Eletrobrás. Nuclear energy is produced by two reactors at Angra.

solar power represents only 1,27% of the energy generated in Brazil. However, Brazil was still the 14th country in the world in terms of installed solar power and the 11th largest producer of solar energy in the world.

The Brazilian government has undertaken an ambitious program to reduce dependence on imported petroleum. Imports previously accounted for more than 70% of the country’s oil needs but Brazil became self-sufficient in oil in 2006–2007. In the beginning of 2020, in the production of oil and natural gas, the country exceeded 4 million barrels of oil equivalent per day, for the first time, making it the 9th largest oil producer in the world.

However, the mining and energy sectors have faced criticism for their environmental and social impacts. Deforestation, water pollution, and the displacement of indigenous communities are some of the issues associated with these industries.

Tourism

Tourism is another important sector, with Brazil attracting millions of visitors each year to its diverse landscapes, cultural heritage, and iconic cities like Rio de Janeiro and Salvador. However, the tourism industry has been impacted by issues such as crime, inadequate infrastructure, and political instability. In the list of world tourist destinations, in 2018, Brazil was the 48th most visited country, with 6.6 million tourists (and revenues of 5.9 billion dollars).

Figure 8: Rio is an internationally renowned tourist destination

Informal Economy

The informal economy is a significant part of Brazil’s economic landscape, with a large portion of the population engaged in informal work. This includes activities such as street vending, unregistered small businesses, and informal labor in sectors like construction and domestic work. Data from the Asian Development Bank and the Tax Justice Network show the untaxed “shadow” economy of Brazil is 39% of GDP.

The informal economy is often seen as a survival strategy for those excluded from formal employment opportunities. However, it also presents challenges, such as lower productivity, lack of social protection for workers, and difficulties in tax collection.

Economic Model

The country’s export model, until today, is excessively based on exports of basic or semi-manufactured products, generating criticism, since such model generates little monetary value, which prevents further growth in the country in the long run. There are several factors that cause this problem, the main ones being: the excessive collection of taxes on production (due to the country’s economic and legislative model being based on State Capitalism and not on Free-Market Capitalism), the lack or deficiency of infrastructure for export(means of transport such as roads, railways and ports that are insufficient or weak for the country’s needs, bad logistics and excessive bureaucracy), high production costs (expensive energy, expensive fuel, expensive maintenance of trucks, expensive loan rates and bank financing for production, expensive export rates), the lack of an industrial policy, the lack of focus on adding value, the lack of aggressiveness in international negotiations, in addition to abusive tariff barriers imposed by other countries on the country’s exports. Because of this, Brazil has never been very prominent in international trade.

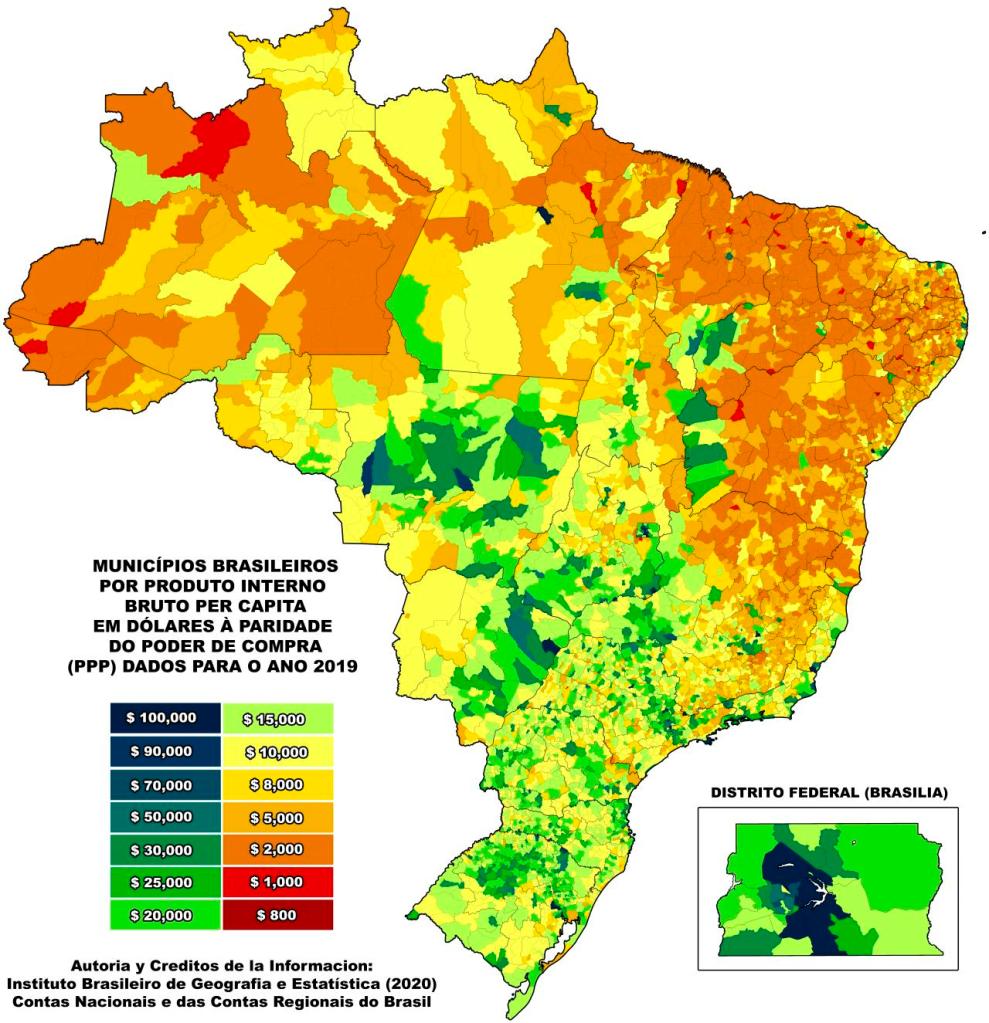

Figure 9: GDP per capita map of Brazil

Brazil’s credit rating was downgraded by Standard & Poor’s to BBB in March 2014, just one notch above junk. It was further downgraded in January 2018 by S&P to BB, which is 2 notches below investment grade. Reasons behind this is that Brazil’s overall regulatory environment is relatively well institutionalized but lacks efficiency, Foreign investment faces bureaucratic hurdles, The financial sector is competitive, but state involvement remains considerable, and public banks account for more than 50 percent of loans to the private sector. Government ownership can influence company decisions in ways that may not always align with shareholder interests. Economic volatility stems from poor fiscal management and an overreliance on commodities. Political instability and widespread corruption has also eroded public trust and investor confidence. Recent scandals include the Odebrecht scandale where since the 1980s, Odebrecht had spent several billion dollars to bribe parliamentarians to vote in favour of the group. Another one is the petrobas scandal from 2014 where many millions of dollars had been kicked back to officials of Petrobras and politicians by prominent Brazilian corporations in return for contracts with Petrobras. Inefficient governance and a cumbersome bureaucracy hinders business and investment. Infrastructure deficits and environmental mismanagement attracted global criticism and posed long-term risks.

Figure 10: The Petrobras scandal was large enough to shake the entire Brazilian economy.

Brazil has the potential to be a great investment arena for investors looking to diversify the geographical aspect of their portfolio. During the period between 2003 and 2014, Brazil experienced a drastic improvement in both social and economic terms. The poorest 40% of the population saw their incomes improve by 7.1%. Many would consider these growth rates to be less impressive than rates seen in China and India, but Brazil nevertheless continues to be an investment hotspot. Brazil ETFs likely have exposure to the Brazilian real, meaning that the ETF’s performance can be affected by currency fluctuations, political scandals, corruption investigations, and impeachment proceedings have all been part of the background to volatile policy shifts in Brazil in recent years. This brings uncertainty and impacts markets Brazil’s equities tend to be less liquid than developed markets. This can increase trading costs for large orders. Brazil’s stock market has experienced extreme booms and busts along with its economy, compared with more developed markets. Many advisors suggest total emerging markets exposure of 5% to 10% of a portfolio. In 2019, Brazil occupied the 4th largest destination for foreign investments, behind only the United States, China and Singapore.

Export/Import

The main countries to which Brazil exports in 2021 were:

- China: US$87.6 billion (31.28%)

- United States: US$31.1 billion (11.09%)

- Argentina: US$11.8 billion (4.24%)

- Netherlands: US$9.3 billion (3.32%)

- Chile: US$6.9 billion (2.50%)

- Singapore: US$5.8 billion (2.10%)

- Mexico: US$5.5 billion (1.98%)

- Germany: US$5.5 billion (1.97%)

- Japan: US$5.5 billion (1.97%)

- Spain: US$5.4 billion (1.94%)

The main countries from which Brazil imports in 2021 were:

- China: US$47.6 billion (21.72%)

- United States: US$39.3 billion (17.95%)

- Argentina: US$11.9 billion (5.45%)

- Germany: US$11.3 billion (5.17%)

- India: US$6.7 billion (3.07%)

- Russia: US$5.7 billion (2.60%)

- Italy: US$5.4 billion (2.50%)

- Japan: US$5.1 billion (2.35%)

- South Korea: US$5.1 billion (2.33%)

- France: US$4.8 billion (2.19%)

Conclusion

Despite the challenges Brazil has faced, the resilience and potential of its economy remain undeniable. The country’s rich natural resources, diverse industrial base, and dynamic agricultural sector continue to provide a strong foundation for growth. Recent efforts toward economic reforms, innovation, and sustainability are setting the stage for a more stable and prosperous future. With its vast resources, vibrant culture, and growing influence on the global stage, Brazil has the opportunity to harness its strengths and drive toward a more equitable and flourishing economy in the years to come.

Anm"al dig f"or att fa 100 USDT

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.