Introduction

Target Corporation has grown from a single discount store into one of the most iconic retail brands in the United States.

Illustration 1: The iconic Target Bullseye Logo

Known for its signature red logo and “Expect More. Pay Less.” philosophy, Target has become a favorite destination for millions of shoppers who value style, convenience, and affordability. From groceries to fashion, home goods to electronics, Target has it all.

From its Minneapolis headquarters, Target manages hundreds of stores across the United States, a sophisticated e-commerce platform, and a growing network of fulfillment and distribution centers.

Its guiding philosophy of blending affordability with style and quality has helped it carve out a unique position in retail.

Unlike traditional retailers that grew cautiously, Target expanded strategically. It focused on curated product offerings. It also emphasized smart store locations and innovative marketing.

By integrating online and offline shopping experiences, Target continues to capture the hearts and wallets of millions.

History

The Target story began in 1962, when George Dayton’s Dayton Company opened the first Target store in Roseville, Minnesota.

From the start, Target differentiated itself from competitors by offering a higher-quality shopping experience at affordable prices.

Illustration 2: The first ever Target store in 1962. Image gathered from: What Target Looked Like When the Retail Giant First Opened – Business Insider

During the 1970s and 1980s, Target expanded steadily across the Midwest. It also expanded in the Southern United States. The focus was on locations that allowed it to serve growing suburban communities.

Illustration 3: Vintage photage from a Target store in the 80s. Gathered from Vintage Photos of What Target Used to Look Like – Business Insider

Unlike discount chains that competed purely on price, Target invested in store design. It also focused on product quality and customer experience. As a result, it earned a loyal following among middle-class Americans.

In the 1990s, Target introduced its SuperTarget stores, combining general merchandise with full grocery sections. This move positioned Target as a one-stop-shop for families, directly challenging Walmart’s dominance in grocery and household essentials.

Target’s expansion has always balanced growth with brand identity. While Walmart pushed for sheer scale, Target cultivated a reputation for style, design, and a curated shopping experience.

In recent years, Target has also embraced digital transformation. Its e-commerce operations, delivery services, and membership programs help it compete with online giants like Amazon.

Illustration 4: A Target Superstore that competes directly with Walmart superstores. Image from Target debuts a super-sized new store design.

Today, Target operates over 1,900 stores nationwide. It employs hundreds of thousands of team members. The company continues to grow its online marketplace and attracts millions of customers every week.

Operations

Nationwide Presence

Target generates revenue through a diverse mix of product categories and services. It blends its physical retail operations with a rapidly expanding digital presence.

Illustration 5: Chritstmas products at target, image from Target Unwraps Immersive Store and Digital Experiences for Holiday Shoppers – Retail TouchPoints.

The company’s core revenue comes from general merchandise, including apparel, home goods, electronics, and beauty products. Its private-label brands, such as Goodfellow & Co. and Up & Up, allow Target to offer stylish, high-quality products at competitive prices. This strategy creates strong customer loyalty and results in higher margins.

Groceries and everyday essentials are another key revenue driver. SuperTarget and traditional Target locations provide fresh produce, packaged foods, and household staples. This segment not only drives foot traffic but also encourages larger shopping baskets.

E-commerce has emerged as a critical growth engine for Target. Its online platform integrates traditional retail with innovative delivery options, including curbside pickup, same-day delivery through Shipt, and a seamless digital marketplace

Membership and loyalty programs, especially Target Circle, enhance revenue. They offer personalized deals, rewards, and promotions. These incentives drive repeat purchases. These initiatives have allowed Target to capture convenience-oriented shoppers. They also capture value-conscious shoppers. This positions Target as a hybrid retailer that thrives across channels.

Target’s Supply Chain

Target’s supply chain is one of its most critical competitive advantages. The company uses strategically located distribution centers and centralized procurement. It has an advanced logistics network. This setup moves goods efficiently from suppliers to stores and directly to customers.

Its sophisticated inventory management systems reduce waste. They maintain stock accuracy and keep pricing competitive. Its private trucking fleet ensures timely delivery across the country. B

Illustration 6: A target Truck.

By combining technology, scale, and operational discipline, Target’s supply chain supports both its physical stores and e-commerce operations. This combination enables the company to offer convenience and reliability that few competitors can match.

Key Competitors

Target operates in a highly competitive retail landscape. Walmart is its most formidable rival. It leverages unmatched scale and a vast grocery footprint. Walmart’s low-price leadership captures a broad segment of everyday shoppers.

Illustration 7: Amazon Go Grocery is becoming a big competitor. Image from Amazon Go Grocery: This Is The Future Of Shopping, Whether We Like It Or Not

Walmart’s aggressive pricing and expansive store network create constant pressure on Target, particularly in mass merchandise and grocery categories. Please see our article for more information about Walmart: Walmart: Stock Analysis (Nov. 2025) – Insightpost %.

Online retail adds another layer of competition. Amazon has reshaped consumer expectations around convenience, delivery speed, and product variety, directly challenging both Target’s digital and physical offerings.

Amazon’s dominance in e-commerce is significant. Its expanding footprint in grocery delivery poses a continuous threat. This forces Target to innovate across its online channels and fulfillment capabilities.

Membership-based retailers such as Costco present another form of competition. By offering bulk products at discounted prices, Costco attracts cost-conscious, loyalty-driven shoppers, directly challenging Target.

Similarly, Dollar General and Dollar Tree continue to expand aggressively in smaller, value-focused markets. They target regions and segments where Target’s larger-format stores may not fit.

Traditional grocers like Kroger, Albertsons, and Publix also compete with Target’s SuperTarget locations in fresh foods and groceries. Meanwhile, global retailers such as Aldi, Lidl, and Carrefour apply additional pressure. They use regional expertise, low-cost strategies and increasingly sophisticated digital tools.

Illustration 8: Carrefour cheese section

Competitive Advantages

Target’s strongest advantage lies in its brand identity. Unlike Walmart, which prioritizes scale and the lowest possible prices, Target has built a reputation around style. It focuses on an elevated shopping experience.

Technology and operational efficiency are central to Target’s advantage. The company has made significant investments in e-commerce, fulfillment, inventory management, and automation.

Its growing network of micro-fulfillment centers and advanced inventory tracking allow Target to process orders quickly. Integrated digital systems ensure accuracy. Customers receive their products with speed and convenience.

Target’s nationwide distribution network and strategically placed store footprint further enhance its efficiency. Products move rapidly from suppliers to stores. They are delivered directly to customers. This is supported by a logistics system that rivals the best in retail.

See next page for Stock analysis,

Stock Analysis

In this section we will analyze Target’s stock to see if it is a good stock to buy or not. Our philosophy is value investing meaning that we try to find good quality companies that are undervalued. However, we will give a holistic overview. This allows all kinds of investors with different philosophies to judge the stock for themselves.

Revenue and Profits

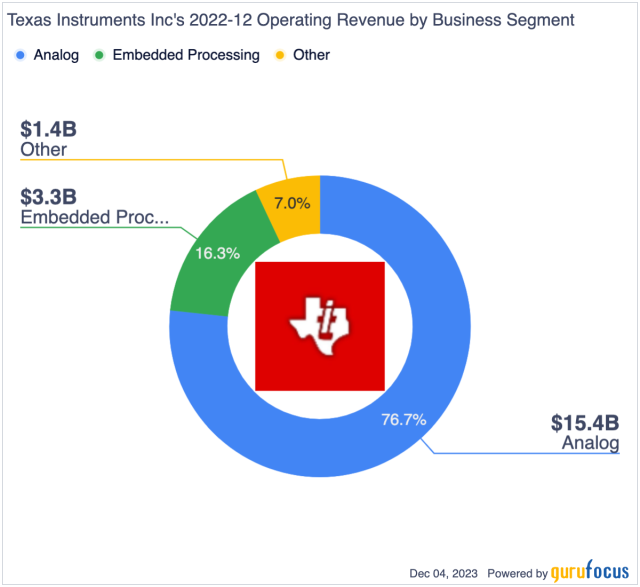

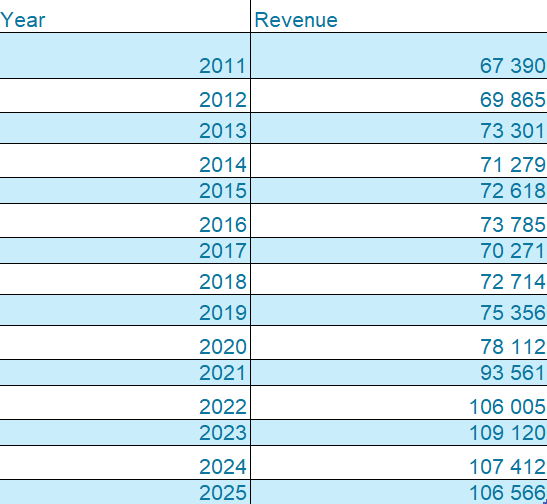

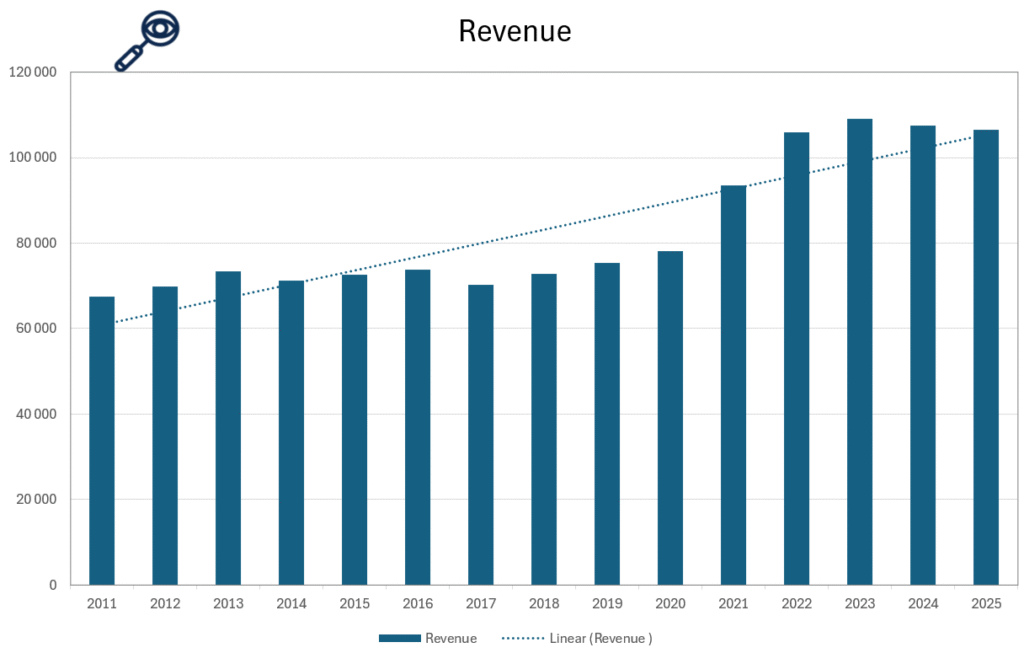

Illustration 9 and 10: Revenue of Target from 2011 to 2025

As shown in Illustrations 9 and 10, Target’s revenue has experienced significant fluctuations over the years. From 2011 to 2020, revenue mainly stayed around the same level. This period reflects stagnation and can be considered a negative signal for consistent growth. The overall trend from 2011 to 2025 has been positive. However, recent data from 2022 to 2025 show that Target continues to experience volatility. Revenue is rising and falling rather than steadily increasing.

Target’s revenue performance between 2015 and 2017 was impacted by various factors, including heightened competition in the U.S. market and operational adjustments in certain underperforming segments, which temporarily suppressed earnings growth.

Overall, while Target has achieved long-term growth from 2011 to 2025, the recurring fluctuations indicate areas of inconsistency. This suggests that investors should be aware of the company’s cyclical performance when considering its stability and long-term prospects. The fluctuation is a red flag that the company has a hard time achieving steady growth.

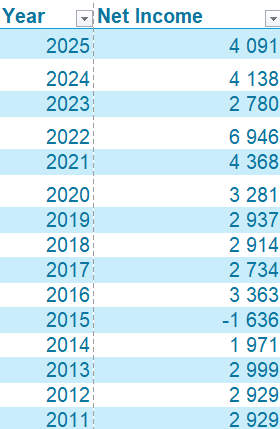

Illustration 11 and 12: Net Income for Target from 2011 to 2025

Net income is a crucial metric to evaluate when determining whether a company is a worthwhile investment. It represents a company’s net profit or loss after accounting for all revenues and income items. All expenses are deducted to calculate the net income as Net Income = Revenue – Expenses.

For Target, as illustrated in figures 11 and 12, several concerning trends appear in the development of net income. The decline in net income from 2011 to 2015 is a clear red flag. It signals operational and strategic challenges during those years. Rising operational expenses affected this period. Competition intensified significantly. The costly impact of Target’s unsuccessful Canadian expansion placed considerable pressure on profitability.

The net income remained flat between 2016 and 2020. There was no meaningful growth during this period. This lack of growth is also a negative sign. A prolonged lack of upward movement suggests stagnation in earnings. This is despite significant investments in digital transformation, store renovations, and supply-chain improvements.

The decline in net income from 2022 to 2023 is another notable warning signal. This drop was largely driven by sharp increases in freight, transportation, and inventory-related costs. Heavy markdowns were also a factor as Target attempted to correct excess inventory. Most significantly, the negative net income in 2015 marks a major red flag. Rising operating costs, margin compression, and persistent competitive pressure have culminated. This move into negative territory reflects these challenges.

Overall, Target’s net income trend raises concerns. The repeated declines (2011–2015 and 2022–2023), the prolonged stagnation (2016–2020), and the negative net income in 2015 collectively indicate that Target has faced significant profitability challenges. Persistent fluctuation without sustained growth is generally a negative sign for long-term financial health.

Revenue Breakdown

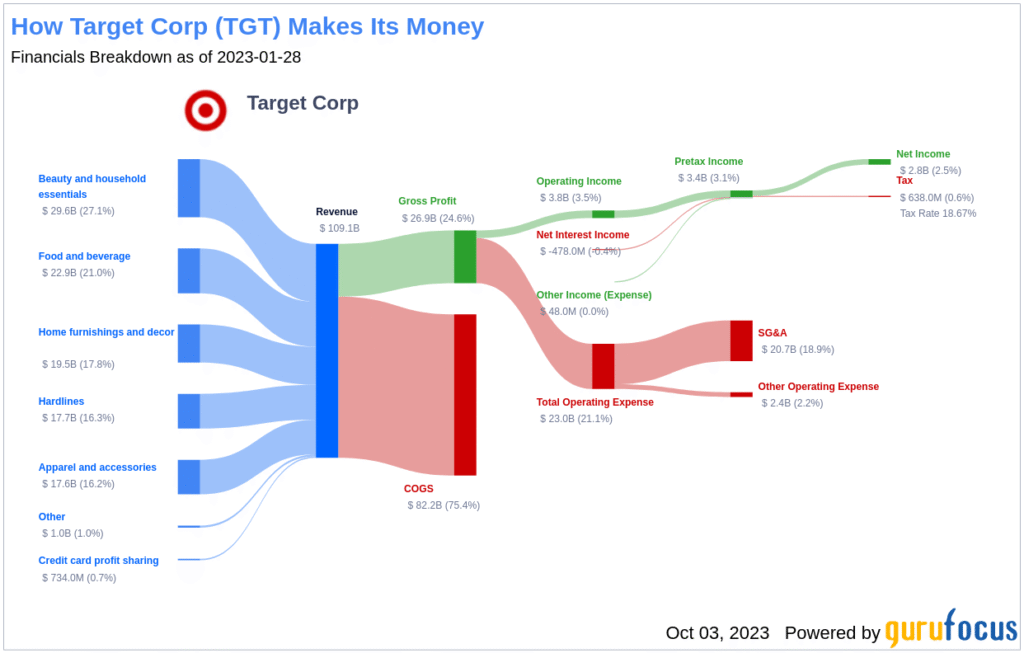

Illustration 13: Revenue breakdown of Target Corp., made by Gurufocus: Target (TGT)’s Hidden Bargain: An In-Depth Look at the 25% Margi

As shown in Illustration 13, Target’s revenue is driven primarily by its U.S. retail operations, as the company operates exclusively within the United States. Essentials & Beauty represents Target’s largest and most stable revenue contributors (around 27%). This category includes household essentials, personal care, cleaning supplies, and beauty products. Because these goods are purchased frequently, this segment provides Target with a reliable baseline of recurring revenue.

Food & Beverage is another major driver, accounting for around 21% share of overall revenue. . Although margins in grocery tend to be lower than in discretionary categories, the steady demand improves store traffic. Apparel & Accessories is one of Target’s historically strong segments and a key differentiator from many other big-box retailers. Target’s private-label apparel brands, combined with affordable pricing, drive strong seasonal demand. However, this category can be sensitive to shifts in consumer spending during inflationary periods. It can also be sensitive during recessionary periods. These conditions can lead to volatility.

Home contributes meaningfully to total revenue (17.8%) but has experienced fluctuations in recent years. After strong performance during the pandemic, demand softened as consumers shifted spending toward services and essentials. This cyclicality makes the Home category more volatile than Target’s other segments. Hardlines, which includes electronics, sporting goods, and toys, accounts for a smaller but still important portion of Target’s revenue. Performance in this segment tends to vary with product cycles and holiday-driven demand. Electronics, in particular, can generate high sales volatility depending on consumer trends and promotional activity.

On the cost side, cost of sales typically consumes a large share of Target’s revenue. This reflects the retailer’s competitive pricing strategy in a low-margin environment. Operating expenses, primarily wages, supply-chain costs, digital-fulfillment expenses, and ongoing store investments—make up most of the remaining cost base.

Earnings per share (EPS)

Illustration 14: EPS for Target Corp. from 2011 to 2025

Earnings Per Share (EPS) is a key financial metric. It shows how much profit a company generates for each outstanding share. It is a strong indicator of profitability, financial health, and long-term value creation. While the absolute EPS number matters less to value investors, the trend in EPS is crucial. A steadily rising EPS signals consistent profit growth and a strong underlying business.

For Target, the decline in EPS from 2013 to 2015 is a clear warning sign. This drop was largely driven by the company’s failed Canadian expansion, which resulted in significant operating losses, high exit costs, and considerable write-downs. These challenges placed heavy pressure on profitability and reduced Target’s earnings on a per-share basis.

The second notable dip, from 2022 to 2023, is also concerning. This decline reflects a combination of sharply rising supply-chain and freight costs, inventory costs and broader inflationary pressures. These factors strained margins and negatively affected earnings, even though revenues remained solid.

However, despite these dips, the overall long-term trend in Target’s EPS is positive. When viewed over a longer time horizon, EPS has generally moved upward. This is supported by strong private-label performance. More efficient store operations have also contributed. This upward trajectory suggests that Target has been able to recover from short-term setbacks and continue creating value for shareholders.

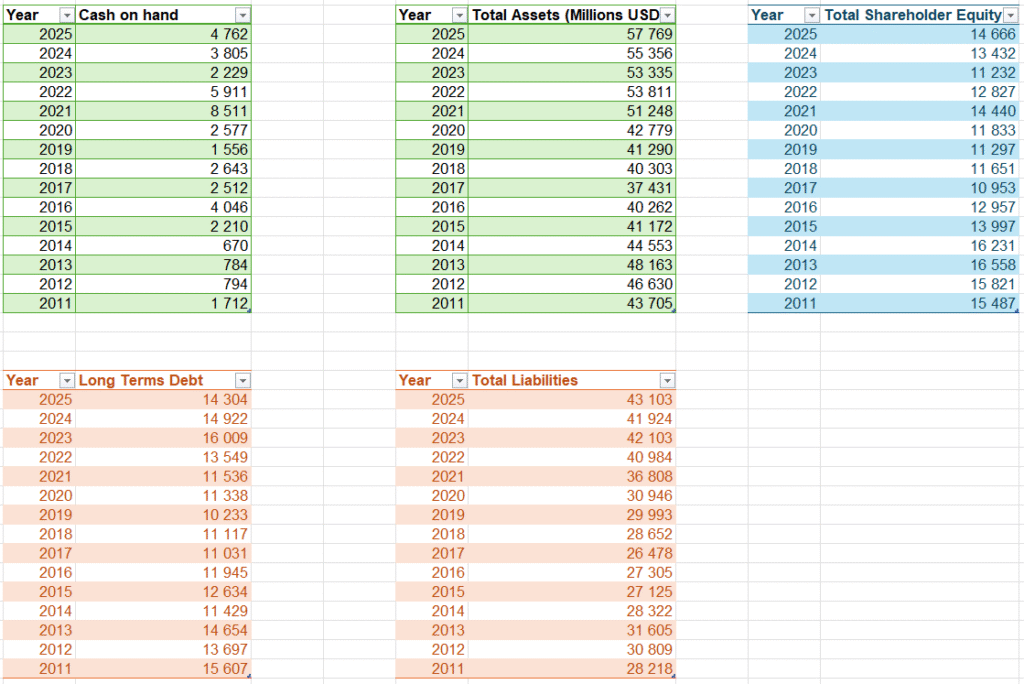

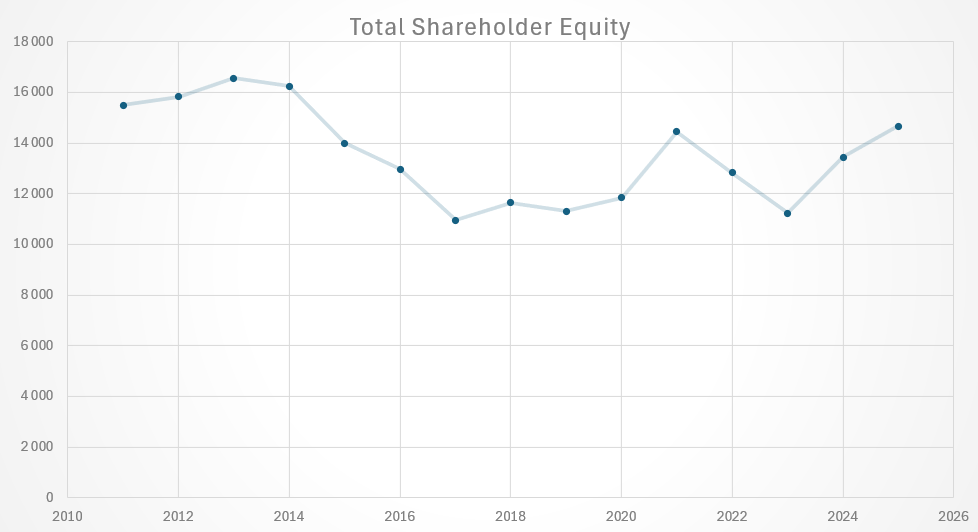

Assets and Liabilities

Illustration 15 and 16: Assets and Liabilities for Target from 2011 to 2025

When evaluating a company as a potential investment, understanding its assets and liabilities is essential. Just as you would assess the equity and assets of a local business before considering a purchase, the same logic applies. This also holds true when analyzing publicly traded companies like Target.

As shown in Illustrations 15, the downward trend in shareholder equity is the most concerning element. A declining equity base is a clear red flag, as it suggests that liabilities may be growing faster than assets. Illustration 15 shows that both total liabilities and assets have grown over time. However, assets are growing more slowly than liabilities. This can result from higher operating costs, inventory write-downs, margin pressures, or share buybacks exceeding retained earnings. Regardless of the specific cause, a sustained decline in equity weakens the company’s financial foundation. It reduces long-term value creation for shareholders.

The growth in Target’s total liabilities can also reflect investments in logistics, technology, inventory management and store modernization. Rising liabilities are not inherently negative, but they become more concerning when viewed alongside Target’s fluctuating cash on hand. Instead of showing a steady increase, cash levels have moved up and down year-to-year, signaling inconsistent liquidity management. More importantly, cash on hand is much lower than Target’s long-term debt. This creates a liquidity imbalance. It limits financial flexibility. It also increases reliance on external borrowing. This is a notable risk factor for investors.

Overall, Target’s balance sheet presents both strengths and significant caution points. Asset growth and ongoing investment in operational capabilities are positive. However, the decline in shareholder equity is a worrying sign. Fluctuating cash levels also raise concerns. Additionally, the large gap between cash on hand and long-term debt is something that investors should monitor closely.

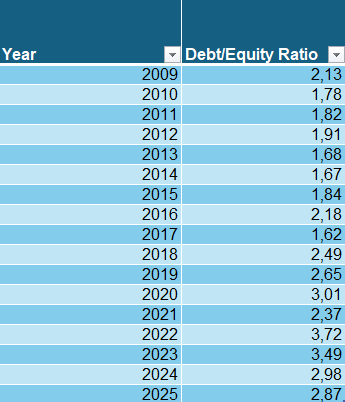

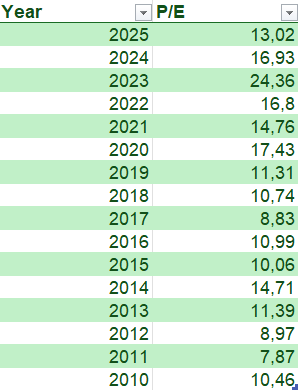

Debt to Equity Ratio

Illustration 17 and 18: Debt to equity ratio for Target from 2011 to 2025

The Debt-to-Equity (D/E) ratio is a key metric for assessing a company’s financial leverage and risk. It measures how much debt a company uses to finance its operations relative to shareholder equity. A higher D/E ratio indicates greater reliance on debt. This reliance can increase financial risk. This is especially true during economic downturns when meeting debt obligations becomes more challenging. Conversely, a lower D/E ratio suggests the company is primarily equity-financed, reducing risk but potentially limiting rapid growth opportunities.

Legendary value investor Warren Buffett generally prefers a debt-to-equity (D/E) ratio below 0.5. Walmart’s D/E ratio, however, stood at approximately 2.81 in 2025. For Target, the D/E ratio has shown a concerning upward trend over recent years, as can be seen in illustration 18. This rise indicates that Target is increasingly relying on debt to fund operations, store remodels, digital investments, and inventory management. While debt can accelerate growth, the steady increase in leverage is a negative sign. It exposes the company to higher financial risk if profitability or cash flow were to weaken.Target is gradually becoming more leveraged. Investors should monitor this situation closely. Continued increases in debt relative to equity could limit financial flexibility. They could also heighten vulnerability to economic shocks.

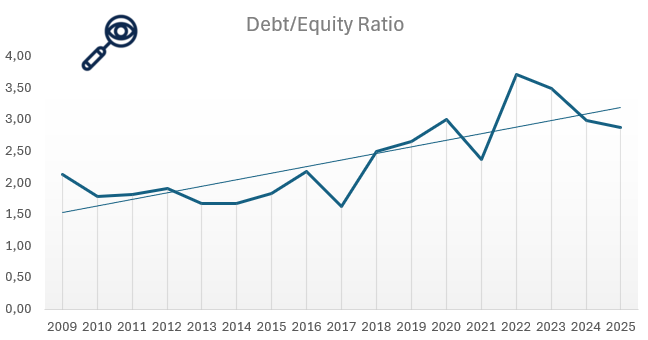

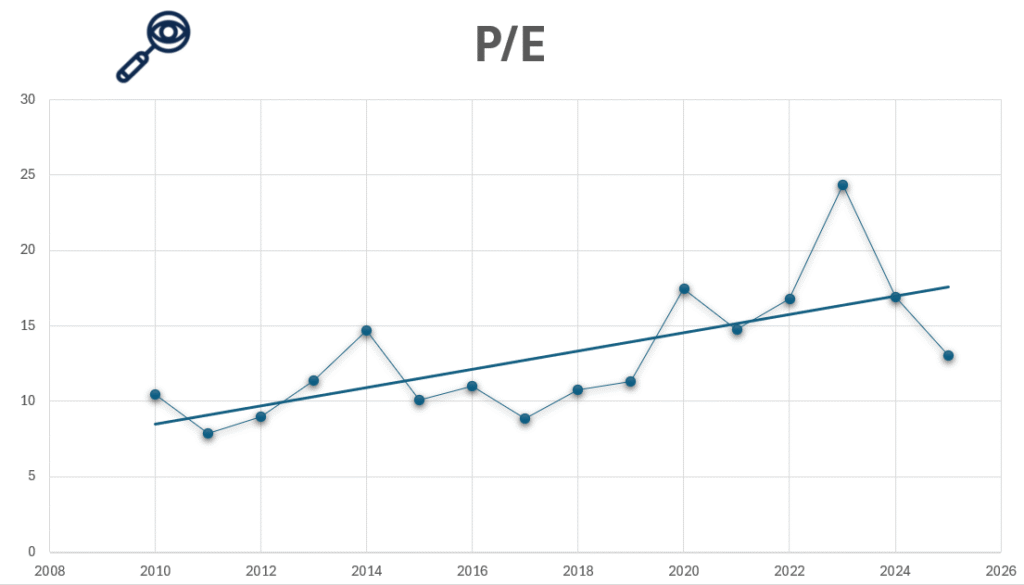

Price to earnings ratio (P/E)

Illustration 19 and 20: P/E Ratio of Target from 2010 to 2025

For value investors, one of the most critical metrics when evaluating Walmart’s stock is the price-to-earnings (P/E) ratio, as it helps assess whether the company is undervalued or overvalued. Even if a company has strong financials, purchasing its stock at a high price can lead to poor returns. For example, imagine a business generating solid profits of $1 million per year. If the owner offers to sell you the business for just $1, it would be an incredible deal. But if the owner asks for $1 trillion, even though the business is profitable, the price would be absurdly overvalued. The stock market works similarly, companies can be priced cheaply on some days and excessively expensive on others.

Warren Buffett, a legendary value investor, typically considers stocks with a P/E ratio of 15 or lower as “bargains.” A high P/E ratio suggests that investors are paying a premium for the company’s earnings, expecting significant growth.

Target’s P/E has declined significantly in recent years. In 2023, it was around 24.36x, and as of 2025 it sits at about 13.02x, reflecting a substantial drop. This recent decline brings the stock back in line with its historical average P/E. Historically, it has generally ranged from 10x to 14x. Therefore, it is fairly valued from a long-term perspective.

The drop in P/E largely reflects a decrease in earnings per share (EPS). Target’s EPS fell from $14.10 in 2022 to $5.98 in 2023, which pressured the stock’s valuation and investor sentiment. The lower P/E indicates that the stock is no longer trading at a high premium. It also reflects recent earnings volatility. The challenges Target has faced include margin pressures, higher operating costs, and inventory management issues.

From a value-investor standpoint, the current P/E suggests that Target is now reasonably valued. The stock may even be modestly undervalued compared with both its recent peak and historical levels. This presents a potential entry point for long-term investors who believe the company can stabilize and grow earnings again. However, caution is warranted, as continued earnings volatility or macroeconomic pressures could make the stock less attractive. Overall, the recent dip in valuation makes Target’s stock more appealing than it has been in recent years. This aligns the price with its earnings. It creates a better opportunity for value-oriented investors.

Price to Book Value (P/B)

Illustration 21 and 22: Price to book value of Target from 2010 to 2025

The price-to-book (P/B) ratio compares a company’s market valuation to its book value. It essentially measures how much investors are paying for each dollar of shareholder equity. A lower P/B ratio can indicate that a stock is undervalued. This means investors are paying less for the company’s assets than they are actually worth. Conversely, a high P/B ratio suggest overvaluation or reflect investor expectations of strong future growth. This metric is often used by value investors to assess whether a stock is trading at a fair price relative to its underlying assets.

For Target, the recent decline in the P/B ratio from around 8.72x in 2022 to approximately 2.58x in 2025 is significant. This sharp drop largely reflects the company’s declining earnings. It also reflects shareholder equity pressures during this period. The pressures are driven by margin compression, higher operating and supply-chain costs, and inventory challenges. The drop was initially a warning sign. Now, the resulting low P/B suggests that Target is trading well below its historical valuation levels. This makes the stock appear undervalued from a value-investor perspective.

At the current P/B of roughly 2.58x, the stock is much closer to the range typically favored by value investors, such as Warren Buffett, who often seeks P/B ratios near or below 2x. This indicates that the market is pricing Target’s shares more in line with the company’s actual assets, rather than speculative growth expectations. The recent dip has stemmed from operational and margin pressures. However, it has created a potential opportunity for long-term investors. Now, the stock is trading at a discount relative to its book value and historical norms.

Return on Investment (ROI)

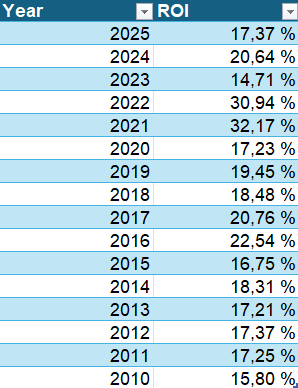

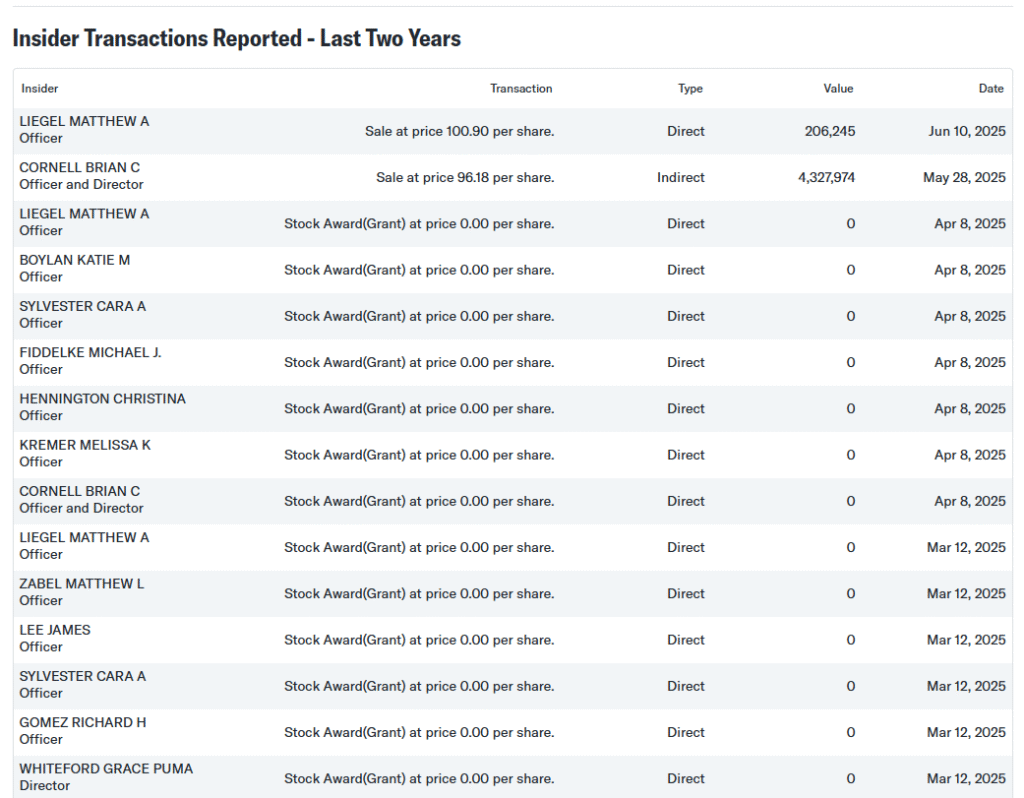

Illustration 23 and 24: ROI for Target from 2010 to 2025

For value investors, Return on Investment (ROI) is a key metric for evaluating Target, as it shows how efficiently the company is using its capital to generate profits. A strong ROI shows that Targetgenerates solid returns compared to the capital it deploys. This makes Target an attractive investment, even if the absolute revenue numbers are large.

Target’s ROI has historically been modest compared with some of its peers. From 2010 to 2020, ROI hovered around 15–20%, reflecting moderate efficiency in its operations and capital deployment. In 2021, ROI spiked sharply to approximately 32%. This increase was largely due to strong sales growth. Higher margins during the post-pandemic retail boom also contributed. Additionally, effective cost management played a role. This temporary surge highlighted Target’s ability to generate excellent returns when market conditions and operational execution align.

However, this improvement proved short-lived. From 2022 through 2024, ROI declined steadily back to around 15%, driven by rising supply-chain and freight costs, margin pressures from heavy markdowns, and higher operating expenses. These factors significantly reduced the efficiency of Target’s invested capital. The lower ROI underscores that, despite strong revenue, the company has struggled to translate sales into proportional returns on investment.

Overall, Target’s ROI remains relatively low, which is a cautionary sign for investors focused on capital efficiency. While the sharp increase in 2021 demonstrated the company’s potential under favorable conditions, the subsequent decline highlights ongoing operational challenges and the need for careful cost and capital management. From a value-investor perspective, the low ROI suggests that returns on invested capital are limited, even though recent strategic initiatives in supply-chain optimization and digital expansion could help improve efficiency over time.

Dividend

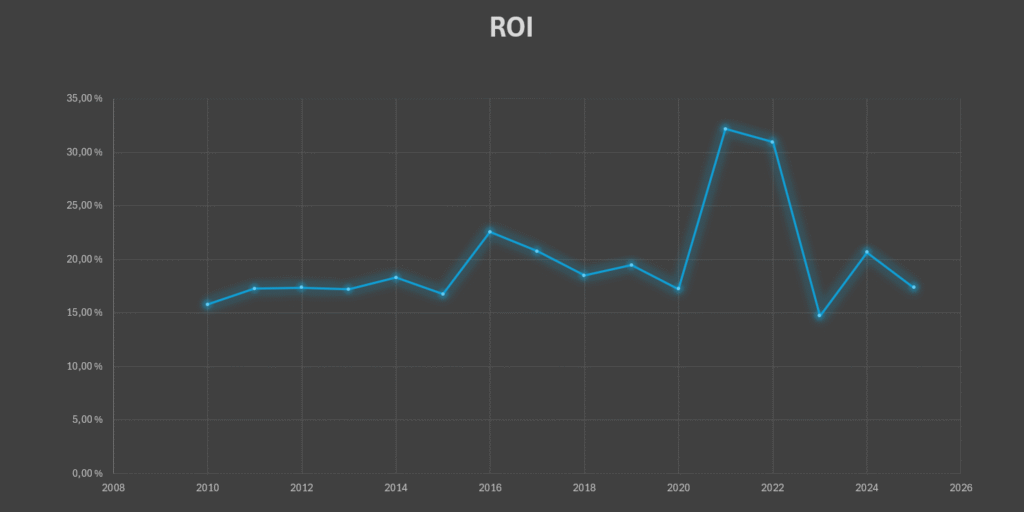

Illustration 25: Target Dividend Yield and dividend payout ratio from 2005 to 2025.

Target currently pays an annual dividend of $4.56 per share, resulting in a yield of approximately 5.45%, with a payout ratio around 55–60%. This moderate payout ratio shows that the dividend is reasonably sustainable. It also allows the company to retain a significant portion of earnings for operational needs, store remodels and inventory management. Additionally, it supports growth initiatives such as digital and supply-chain expansion.

The relatively high yield is attractive for income-focused investors. However, it also reflects some market caution regarding Target’s earnings volatility. Additionally, there have been margin pressures in recent years. Despite this, Target has a long history of consistent dividend payments. It has modest, steady increases. This demonstrates a commitment to returning value to shareholders.

Overall, Target’s dividend profile is a green flag. The dividend is generous and covered by earnings. It provides a reliable income stream. Meanwhile, the company maintains sufficient retained earnings to support ongoing investments.

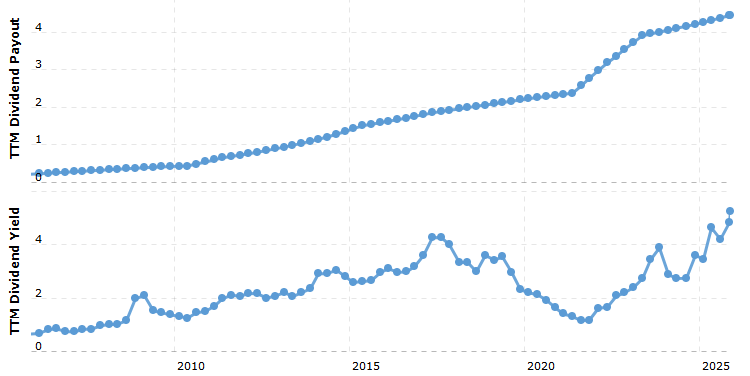

Insider Trading

Illustration 26: Most recent insider trading at Target, gathered from Target Corporation (TGT) Recent Insider Transactions – Yahoo Finance. Please consult yahoo finance for most recent list.

In recent months, Target insiders have sold a significant amount of stock, which can be considered a red flag for investors. CEO Brian Cornell sold approximately 45,000 shares at an average price of $96.18, worth over $4 million. Chief Accounting Officer Matthew Liegel also sold shares during the same period. Most of these sales were conducted under prearranged Rule 10b5‑1 trading plans, which allow insiders to sell shares according to a pre-approved schedule. The scale of these transactions is notable. It could signal that insiders may have concerns about the near-term upside of the stock.

Rule 10b5‑1 plans reduce the likelihood that trades reflect a sudden loss of confidence. Despite this, the combination of large insider sales and relatively modest insider ownership in Target suggests caution. It may indicate that key executives are taking profits while the stock price is elevated, which can be a warning sign for potential investors. Target’s insider trading policy requires trades to occur during open windows and under pre-approved plans, providing governance oversight. However, the recent activity still highlights that insiders are reducing their exposure.

Other Company info

Founded in 1902, Target Corporation is one of the largest and most recognized retail chains in the United States, known for its combination of affordable products, stylish merchandise and growing e-commerce presence. As of 2024, Target employs approximately 450,000 people across its stores, distribution centers, and digital operations. The company is publicly traded on the New York Stock Exchange under the ticker symbol TGT and operates within the Consumer Discretionary sector, specifically in the Retail—Discount Stores industry.

Target is headquartered at 1000 Nicollet Mall, Minneapolis, Minnesota, USA. As of 2024, the company has roughly 496 million shares outstanding, with a market capitalization of around $95 billion USD. For more information, visit Target’s official website: https://corporate.target.com

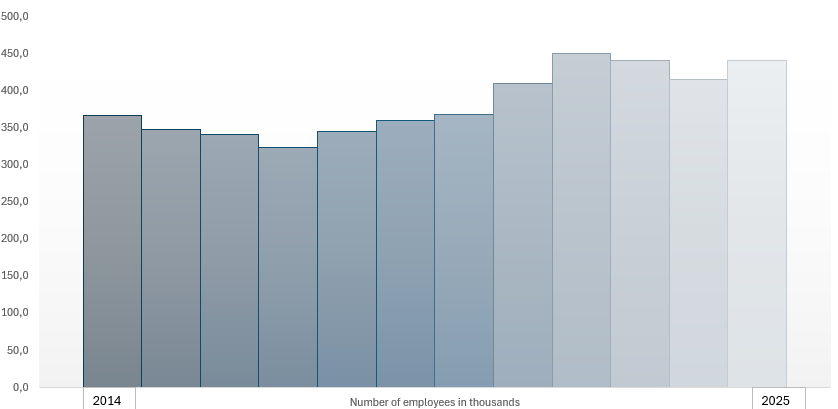

Illustration 27-29: Number of employees and location of Target Corp.

Final Verdict

Overall, Target is not recommended as a value investment at this time. While the stock may appear reasonably priced, recent declines in sales, lowered earnings guidance, its reduced shareholder equity, fluctuating revenue, low ROI, high debt to equity ratio and net income and notable insider selling suggest caution.

Competitive pressures and operational challenges in the retail sector limit upside potential. This situation makes Target a red flag for long-term investors, even though it has a strong brand and solid operations.