Introduction to the Company

NextEra Energy, Inc. is one of the largest energy companies in the United States and a global leader in renewable energy. With a strong commitment to sustainability and innovation, NextEra Energy has positioned itself as a key player in the transition toward cleaner energy solutions. The company primarily focuses on generating electricity through renewable sources while maintaining reliability and affordability for millions of customers.

Illustration 1: NextEra Energy logo, symbolizing renewable energy with use of green colour and leaf like wave.

History and Background

NextEra Energy traces its origins back to 1925, when it was founded as Florida Power & Light Company (FPL). Over the years, the company expanded its operations and evolved into a diversified energy powerhouse. In 1984, FPL Group was established as the parent company, and in 2010, it was rebranded as NextEra Energy to reflect its growing emphasis on renewable energy.

Today, NextEra Energy is headquartered in Juno Beach, Florida, and has grown through strategic acquisitions and investments in wind, solar, and battery storage technologies. The company owns and operates one of the world’s largest portfolios of renewable energy assets, making it a key player in the clean energy transition.

Operation and Services

NextEra Energy serves a vast customer base across 49 states in the U.S. and four Canadian provinces. The company operates through two major business segments:

Florida Power & Light Company (FPL) – This segment focuses on electricity generation, transmission, and distribution in Florida. It is the backbone of the company’s regulated electric utility business, serving over 5.8 million customer accounts

NextEra Energy Resources – This segment handles renewable energy generation, including wind, solar, and battery storage projects. It also manages natural gas pipelines and nuclear power plants, ensuring that NextEra Energy is a key player in the transition toward cleaner energy sources

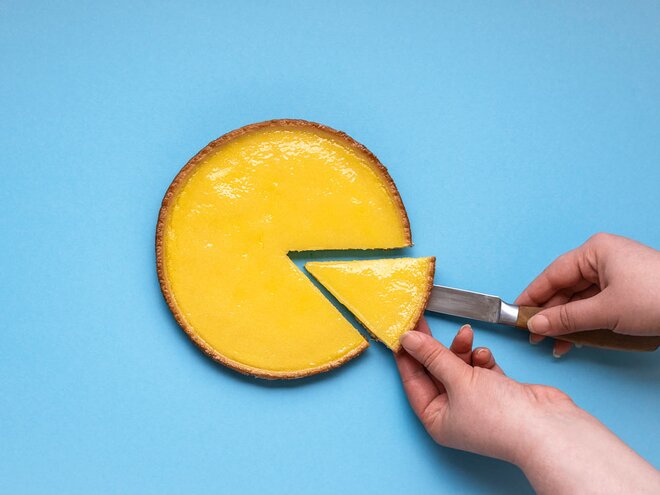

As can be seen from illustration two, the majority of NextEra’s energy generation comes from wind and solar power.

Illustration 2: The generation allocation of NextEra Energy

Wind Energy makes up 67% of its generation while solar makes up 13%. NextEra Enegy is as such a fanatstic company to invest in for those that want to be exposed to the renewable energy market.

The company is also invested in nuclear energy, constituiting 11% of its total energy generation, while only a minor part of the business constituting 6% is part of the Natural gas market.

Challenges and Controversies

Environmental Concerns: Despite its significant investments in renewable energy, NextEra Energy has faced criticism for its environmental impact. The company has been involved in disputes over the development of certain projects that environmental groups claim disrupt ecosystems and communities. Additionally, the capital-intensive nature of renewable energy projects has raised concerns about the sustainability of its financial practices

Regulatory and Legal Issues: Operating in a highly regulated industry, NextEra Energy has encountered various regulatory and legal challenges. These include disputes over rate adjustments, infrastructure expansion, and compliance with federal and state environmental laws. The company has also been involved in legal battles to block competing energy projects, which has drawn scrutiny and criticism

Competition

NextEra Energy operates in a highly competitive landscape, facing significant competition from other major utility and renewable energy companies. Some of its main competitors include: Southern Company (SO), Duke Energy (DUK), Entergy (ETR9, PPL Corporation (PPL), FirstEnergy (FE), Eversource Energy (ES), Edison International (EIX), Pinnacle West Capital (PNW), OGE Energy (OGE), and IDACORP (IDA).

These companies are all part of the electric utilities industry and compete with NextEra Energy in various aspects, including market share, technological advancements, and regulatory compliance.

NextEra Energy stands out from its competitors by being the world’s largest generator of wind and solar power, leading the transition to a low-carbon future. Its size and expertise gives it a competitive advantage. The investments the company has made in getting more advanced technologies to enhance efficiency and reduce costs, also solidifies their competitive edge.

However, the highly competitive environment in which they operate is a factor that investors should carefully consider, as it could pose potential risks.

Future outlook

Several factors will shape NextEra Energy’s future:

Expansion of Offshore Wind: NextEra Energy’s offshore wind projects will play a critical role in achieving clean energy goals. As more offshore wind projects receive government backing, NextEra stands to benefit from regulatory support and technological advancements.

Electrification of Transportation: As electric vehicle (EV) adoption grows, NextEra Energy is investing in EV infrastructure, including charging stations and grid upgrades to accommodate increased demand.

Advancements in Energy Storage: The development of more efficient and cost-effective battery storage solutions will be crucial for integrating intermittent renewable energy sources like solar and wind.

Stock Analysis

In this section, we will analyze NextEra Energy stock to determine if it is a good investment. Our philosophy is value investing, which means we seek high-quality companies that are undervalued. However, we will provide a comprehensive overview so that investors with different philosophies can evaluate the stock for themselves.

Revenue and Profits

To assess a company’s value and investment potential, revenue and profits are the logical starting points for analysis. A stock represents an actual business, much like the small businesses in your hometown. If someone offered to sell you their company, your first question would likely be about its earnings. The same principle applies when evaluating a publicly traded company—understanding its financial performance is essential before deciding to invest.

Illustration 2 and 3: Revenue of NextEra Energy from 2009 to 2024.

As seen in Illustrations 2 and 3, NextEra Energy’s revenue has shown a long-term growth, particularly in recent years. This expansion is driven by increasing demand for renewable energy, investments in infrastructure, and the company’s leadership in wind and solar power generation. Additionally, supportive government policies, tax incentives, and commitments to clean energy continue to drive sales, positioning NextEra Energy for sustained growth.

However, despite this overall upward trend, NextEra Energy’s revenue growth has experienced fluctuations. As shown in Illustrations 2 and 3, there have been periods where revenue declined due to factors such as regulatory changes, shifts in energy prices, and project timing. The utility and renewable energy sectors are subject to policy adjustments and market dynamics that can impact earnings, making it essential for investors to consider these risks. It is especially important to note that the Trump administration is opposed to the Wind sector which stands for the majority of NextEra’s energy generation.

Even with occasional volatility, the long-term outlook remains strong. With the increasing global transition to renewable energy, NextEra Energy is well-positioned to capitalize on this shift. Its investments in clean energy infrastructure, expansion into emerging markets, and strong operational efficiency suggest a promising future despite short-term revenue fluctuations. However, it has a lot of competitors and the current US administration is not as supportive of renewable energy as previous administrations.

Illustration 4 and 5: Net Income of NextEra Energy from 2009 to 2025

Net income is a crucial metric to evaluate when determining whether a company is a worthwhile investment. It represents a company’s net profit or loss after accounting for all revenues, income items, and expenses, calculated as Net Income = Revenue – Expenses.

As illustrated in Figures 4 and 5, NextEra Energy has experienced significant net income growth over the long term, particularly in recent years. For instance, the company’s net income rose from $3.573 billion in 2021 to $4.147 billion in 2022, marking a 16.06% increase. This upward trend continued in 2023, with net income reaching $7.31 billion—a substantial 76.27% increase from the previous year. This growth is driven by rising global demand for renewable energy, strategic investments in wind and solar projects, and expansion into energy storage and infrastructure development. Additionally, favorable government policies and commitments to clean energy continue to fuel revenue, positioning the company for sustained growth.

However, despite this overall upward trend, NextEra Energy’s net income has experienced fluctuations. In 2024, the company’s net income decreased by approximately 8.79% to $6.952 billion, down from $7.31 billion in 2023. This decline is partly due to increased costs impacting its renewables segment and higher operating expenses. And ofcoursw it had a sharp fall from 2018 to 2020. For investors, this inconsistency raises concerns, as it suggests that NextEra Energy may not deliver steady net income growth year after year, making it a potentially riskier investment compared to companies with more predictable financial performance. Even though net income growth has been inconsistent, the long-term trend remains upward. Considering the rising global demand for energy, the increasing popularity of renewable power, and the momentum of the green energy transition, NextEra Energy is well-positioned for future growth. These factors, combined with the company’s expanding project backlog and strategic partnerships, suggest a promising outlook despite short-term volatility.

Revenue breakdown

Illustration 6: Revenue Breakdown for NextEra Energy, gathered from gurufocus as of NOV 31, 2023.

As can be seen in Illustration 6, the majority of NextEra Energy’s revenue comes from Florida Power & Light Company, but a significant portion (17.8%) is generated by NextEra Energy Resources LLC. This diversification provides investors with exposure to both clean energy growth and the stability of a traditional utility business. Despite cost of goods sold (COGS) consuming a substantial share of its revenue, the company continues to have a significant and good amount of revenue. Additionally, high capital expenditures for clean energy development and grid modernization impact profitability. While NextEra Energy benefits from a strong market position and steady utility revenue, these costs could affect its long-term earnings growth, making it an important factor for investors to consider.

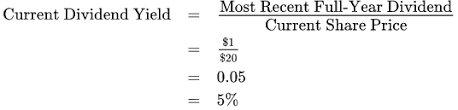

Earnings per shar (EPS)

Earnings Per Share (EPS) is a key financial metric that measures a company’s profitability on a per-share basis. It indicates how much profit a company generates for each outstanding share of its stock, and is used o assess a company’s financial health, profitability, and potential for growth. In other words this metric can tell us how profitable the business is.

Illustration 7: Earnings per share for NextEra Energy from 2009 to 2025

The EPS figure itself isn’t the primary focus for value investors—it can be 0.2 or 10, but what truly matters is the company’s ability to generate consistent earnings growth. A steadily increasing EPS over time signals strong financial health, profitability, and long-term value creation.

The EPS for NextEra Energy has had a generally positive upward trend since 2009. However, it experienced a dramatic fall from 2019 to 2020 due to the economic downturn and market disruptions caused by the COVID-19 pandemic, along with increased costs and project delays. This decline can be a red flag for investors, as it highlights the company’s sensitivity to external economic factors and potential volatility in earnings. However, after the fall, the trend has resumed its upward trajectory, supported by strong investments in renewable energy, stable utility revenue from Florida Power & Light, and favorable industry policies. As a result, the EPS has now returned to pre-fall levels, reinforcing NextEra Energy’s resilience and long-term growth potential. The pandemic can also be considered a one-time event, and the fall in 2024 due to rising interest rates and increased costs in the renewables sector can also be seen as a temporary setback rather than a long-term structural issue. Given NextEra Energy’s strong track record of recovery and consistent long-term growth, these fluctuations are likely part of normal business cycles rather than a sign of fundamental weakness.

Assets and Liabilities

Illustration 8 and 9: Assets and liabilities for NextEra Energy from 2009 to 2023

When evaluating a company as a potential investment, understanding its assets and liabilities is crucial. If a local business owner offered to sell their shop to you, one of the first questions—after determining its profitability—would be about its equity and assets. The same principle applies when assessing publicly traded companies like Dominion Energy.

As shown in Illustration 8, NextEra Energy’s total assets reached $177.5 billion in 2023, a strong figure that highlights the company’s financial growth. Additionally, NextEra Energy’s asset base has consistently expanded year over year, increasing from $48.5 billion in 2009 to $177.5 billion in 2023. This steady asset growth is a positive indicator of the company’s ongoing expansion, investments in innovative technologies, and strengthened market position. A continuously growing asset base often signifies a company’s ability to scale operations, acquire new projects, and enhance production capacity which is particularly important in the highly competitive renewable energy industry.

At the same time, NextEra’s total liabilities have also increased significantly, rising from $35.5 billion in 2009 to $119.7 billion in 2023. While such a sharp increase in debt might raise concerns for some investors, it is not necessarily a red flag given the nature of the renewable energy business. Utility companies typically operate in a capital-intensive environment where they must secure substantial financing to fund large-scale projects, develop infrastructure, and maintain their competitive edge. Debt financing is often necessary for expanding wind farm and other types of energy production, all of which contribute to long-term growth.

The key factor for investors is whether NextEra can effectively manage its debt while maintaining strong revenue and profitability. If the company can generate consistent cash flow and sustain high demand for its products and services, its rising liabilities may not be a major issue. However, if debt levels continue to grow faster than revenue or profits, it could indicate financial strain, making it important for investors to monitor the company’s ability to service its obligations while maintaining profitability.

The cash on hand for NextEra is a red flag for potential investors, as the company has $2.7 billion in readily available cash as of 2023. This amount is relatively low compared to its liabilities, which could indicate liquidity concerns and a reliance on external financing to meet obligations and fund growth.

Additionally, NextEra’s long-term debt of $61.4 billion in 2023 is significantly higher than its available cash, which is a red flag for investors. This indicates that the company relies heavily on debt financing, which could pose risks if interest rates rise or if cash flow weakens, potentially impacting its ability to meet financial obligations and sustain growth.

As seen in Illustration 9, Total Shareholder Equity—calculated as total assets minus total liabilities—has consistently grown over the past 14 years. This is a very positive indicator for potential investors, as it suggests that NextEra is building value over time rather than eroding its financial foundation. A steadily increasing shareholder equity indicates that the company’s assets are growing at a faster rate than its liabilities, which is a green flag for financial health. This trend suggests that NextEra is successfully expanding its operations while maintaining a solid balance sheet. Additionally, rising equity provides a buffer against financial downturns, making the company more resilient in times of economic uncertainty. However, investors should also consider how this growth is achieved—whether through profitable operations or increased debt financing—to fully assess the sustainability of this trend.

Debt to Equity Ratio

Illustration 10 and 11: Debt to equity for NextEra Energy from 2009 to 2023

The Debt-to-Equity (D/E) ratio is an important financial metric for assessing Next Era’s financial leverage and risk. It compares the amount of debt the company uses to finance its operations relative to its shareholder equity. A high D/E ratio suggests that the company relies more heavily on debt to fuel growth, which could increase financial risk, especially during economic downturns when managing debt obligations becomes more challenging. In contrast, a lower D/E ratio indicates that Next Era is primarily financed through equity, reducing financial risk but potentially limiting its ability to rapidly expand.

The D/E ratio of NextEra Energy has been on a downward trend from around 2.8 in 2009–2010 to 2.05 in 2024. This is a positive sign for investors since it indicates that the company is gradually reducing its reliance on debt relative to equity. A lower D/E ratio suggests improved financial stability, reduced risk of overleveraging, and a stronger ability to manage long-term obligations while continuing to invest in growth.

Legendary value-investor Warren Buffett prefers a D/E ratio of below 0.5. Compared to 0.5, NextEra is still at a very high level. However, this is normal for companies in the renewable utility industry since they often require significant capital investment to fund large-scale projects, develop infrastructure, and expand renewable energy capacity. While NextEra’s D/E ratio is higher than Buffett’s preferred level, it reflects the capital-intensive nature of the energy sector and the company’s ongoing efforts to scale its operations and meet growing demand for clean energy.

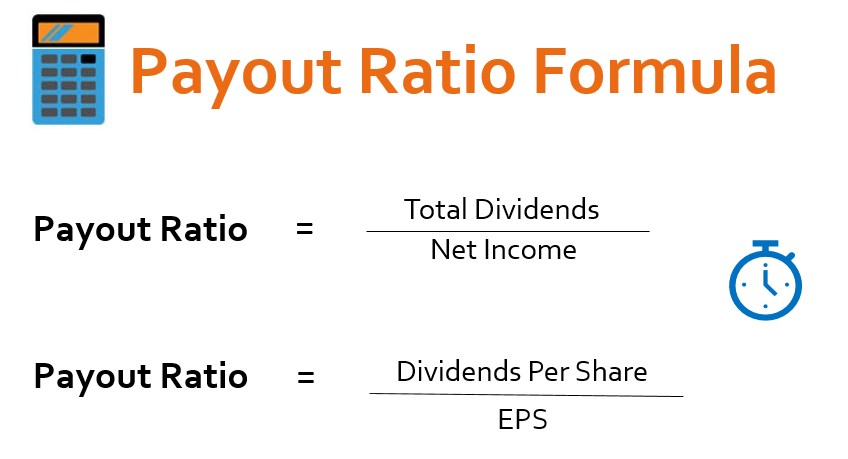

Price to earnings ratio (P/E)

Illustration 12 and 13: Price to earnings ratio for NextEra Energy from 2009 to 2023

For value investors, one of the most critical metrics when evaluating NextEra’s stock is the price-to-earnings (P/E) ratio, as it helps assess whether the company is undervalued or overvalued. Even if a company has strong financials, purchasing its stock at a high price can lead to poor returns. For example, imagine a business generating solid profits of $1 million per year. If the owner offers to sell you the business for just $1, it would be an incredible deal. But if the owner asks for $1 trillion, even though the business is profitable, the price would be absurdly overvalued. The stock market works similarly—companies can be priced cheaply on some days and excessively expensive on others.

Warren Buffett, a legendary value investor, typically considers stocks with a P/E ratio of 15 or lower as “bargains.” A high P/E ratio suggests that investors are paying a premium for the company’s earnings, expecting significant growth. However, this also indicates that the stock is expensive relative to its earnings, which can be a red flag for value investors. NextEra’s P/E ratio has been on a relatively stable level from 2010 to 2018. From 2018 as renewable stocks became popular on the stock market its P/E skyrocket to a high of 107.21 in 2022 which is strongly overprices. Before the bubble burst and it came back to 17.19 in 2024.

The mania for renewable energy stocks seems to have slowed down after the bubble burst in 2022. For potential investors, the P/E of 20.2 in 2025 seems fairly priced, meaning that you will not be buying at a bargain but also not overpaying for the stock. If you believe in the company’s future earnings potential and strong fundamentals, it could be a good time to enter at a reasonable valuation and hold for long-term growth.

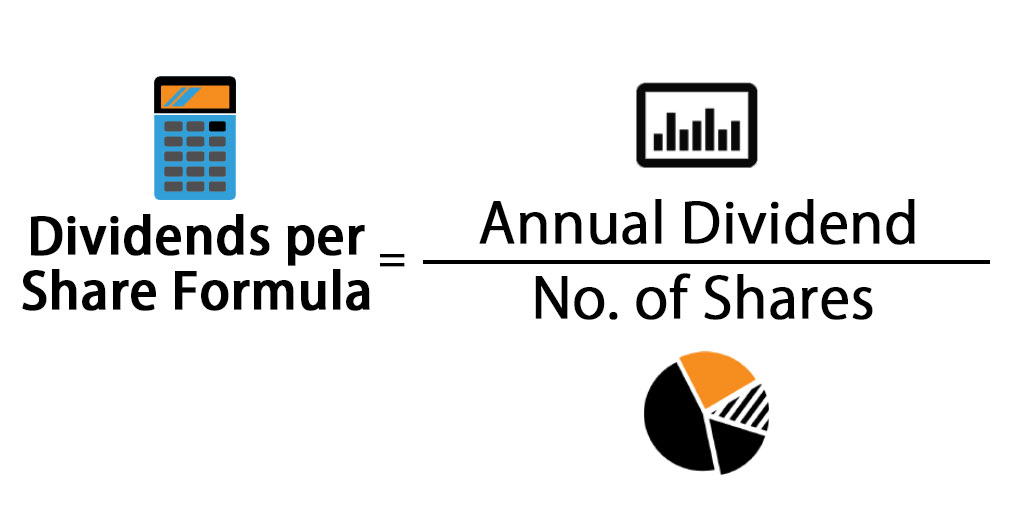

Dividend

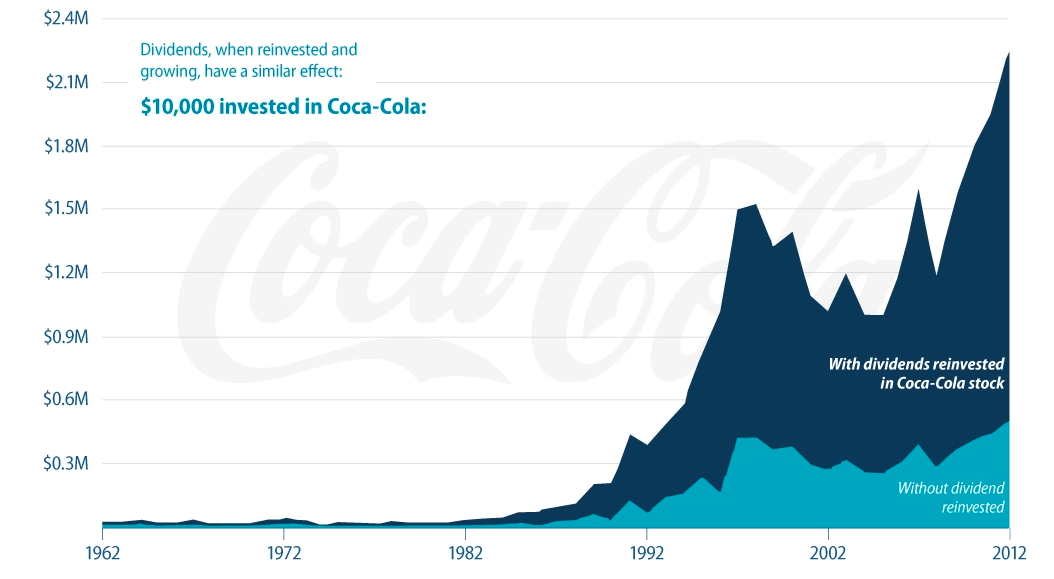

Illustration 14: NextEra Energy’s dividend yield and dividend payout from 1995 to 2025

NextEra Energy stands out among renewable energy companies by offering a consistent dividend, making it an attractive option for income-focused investors. In 2025, NextEra’s annual dividend is $1.55 per share, reflecting its commitment to returning value to shareholders. Additionally, the company has a strong track record of increasing its dividend, with a five-year annualized growth rate of approximately 10%, demonstrating steady financial health and shareholder rewards.

NextEra Energy has demonstrated remarkable consistency in its dividend payments, making it a reliable choice for income-focused investors. The company has increased its dividend for over 25 consecutive years, reflecting strong earnings growth and disciplined financial management. Even during economic downturns and market volatility, NextEra has continued to raise its payouts, reinforcing its commitment to returning value to shareholders. This level of consistency is a positive sign, as it indicates that the company generates stable cash flows and prioritizes rewarding long-term investors while continuing to invest in its renewable energy expansion. However, as can be seen in illustration 14, despite the dividend payout increasing, the dividend yield has been on a steady decline.

While NextEra’s dividend yield of around 2.2% (as of 2025) may not be the highest in the utility sector, it remains a reliable source of income, especially when combined with the company’s long-term growth prospects in renewable energy. For investors seeking a mix of dividend income and exposure to clean energy, NextEra presents a compelling case. However, given its high debt levels and capital-intensive business model, investors should monitor whether the company can sustain its dividend growth while continuing to invest in future expansion.

To summarize:

✅ Green Flag:

- Consistent Dividend Growth: NextEra has a strong history of dividend increases, making it a solid choice for income investors.

- Balanced Strategy: The company provides both income and long-term growth potential, appealing to a broad range of investors.

🚩 Red Flag:

- Debt Reliance: Maintaining dividends alongside significant capital expenditures requires careful financial management.

- Moderate Yield: While NextEra pays dividends, its yield is lower than some traditional utility stocks.

Insider Trading

Illustration 14: Recent Insider Selling for NextEra Energy

A crucial metric to consider when evaluating whether a company is worth investing in is insider trading activity—specifically, whether company insiders have been buying or selling shares over the past year. It’s particularly important to assess who has been trading, as directors should be monitored even more closely than officers.

As can be seen from the table above, there has been no selling by any mayor insiders recently. The insiders who have been selling stock has been lower level officers and directors of subsidiaries. This is a green flag for investors since it shows that insiders are confident in the company as they have not sold their shares.

Other Company Info

As illustrated below, NextEra Energy currently employs approximately 16,800 individuals, reflecting a steady increase from 14,900 employees in 2020. The company was originally founded in 1925 as Florida Power & Light Company and later rebranded as NextEra Energy in 2010 to reflect its expansion into renewable energy. It is publicly traded on the New York Stock Exchange under the ticker symbol NEE. Operating within the Utilities sector, NextEra Energy is classified under the Electric Utilities industry. The company has approximately 2.06 billion shares outstanding and a market capitalization of around $120 billion USD as of 2024.

Headquartered at 700 Universe Boulevard, Juno Beach, Florida 33408, United States, NextEra Energy’s official website is www.nexteraenergy.com.

Illustration 15-17: : Number of employees at NextEra Energy and its location in Juno Beach, Florida.

Final Verdict

NextEra Energy offers a compelling opportunity for investors seeking exposure to renewable energy, particularly wind and solar power, as well as energy storage solutions. The company has secured significant contracts with major corporations like Google and Walmart and continues to expand its clean energy initiatives. With a strong focus on sustainability and innovation, NextEra is well-positioned to capitalize on the increasing demand for carbon-free energy and play a leading role in the transition to a greener economy.

However, while NextEra Energy has experienced strong growth, there are some concerns related to its financial performance. Despite increasing revenue, high capital expenditures and significant debt levels to fund its renewable energy projects have put pressure on profitability. Additionally, the company’s cost of sales (COGS) remains substantial, impacting margins. While NextEra has maintained a stable dividend and solid market position, its reliance on debt and ongoing capital investment may raise concerns for some investors.

That said, it is important to note that NextEra Energy is a leader in the renewable energy space and is poised for long-term growth given the ongoing expansion of clean energy infrastructure. For growth-oriented investors who believe in the future of renewable energy and are willing to accept potential short-term financial volatility, NextEra presents a strong investment opportunity. However, for more conservative investors seeking a company with consistent profitability and low financial risk, NextEra Energy may not be the ideal choice.